Back in April, early in the throes of the pandemic, Insight Partners LLC closed a $9.5 billion fund to invest in software companies.

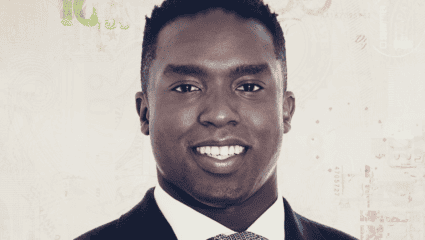

“We were bullish on the resilience of the software sector,” Insight managing director Lonne Jaffe told The Deal. The firm would use capital to help companies achieve scale, though Jaffe said it was not clear if the pace of investment would slow.

“Economic downturns have a way of shining a light on businesses that are particularly compelling to customers,” he said.

While there were slowdowns among some potential investments, reactions to the pandemic had some unanticipated effects. “Companies became a little bit more conservative when it came to spending and some operating metrics started to actually improve pretty significantly, such as gross margins and customer acquisition costs,” Jaffe said.

The pace of investment remained roughly on track, as the firm backed companies such as digital white-boarding and collaboration-technology developer Mural, which is formally known as Tactivos Inc.; IT infrastructure company Granulate Cloud Solutions Ltd.; telehealth technology company TytoCare Ltd.; and Imperfect Foods Inc., a delivery service that features misshapen carrots and other foods.

“It has been more or less the same as last year, with slightly fewer deals but slightly larger deal sizes,” said Jaffe, who is set to appear on a panel during “The Deal Economy: Predictions and Perspectives,” a web event hosted by The Deal from Monday, Sept. 21, to Sept. 24.

Insight has about $30 billion in capital commitments and has invested in a little more than 400 high-growth technology companies over the past 25 years. Former portfolio companies include Alibaba Group Holding Inc. (BABA) and Twitter Inc. (TWTR).

“They’re not ‘startup’ startups,” Jaffe said of the typical Insight investment, which the firm dubs “Scaleups.”

“They’re still growing rapidly, so it’s not late-stage companies that are primarily about returning capital,” he said. Because they have demonstrated growth, he added, “the world has done some of the due diligence for you.”

Jaffe joined Insight as a managing director in 2017. His introduction to the firm came during the recruitment process for the CEO role at Insight portfolio company Syncsort Inc., which has rebranded as Precisely. He landed the job.

Prior postings including managing teams and running businesses for IBM Corp. (IBM). Jaffe later led deals for IBM and CA Technologies Inc.

“It’s a pretty unusual background for an investor in that it’s mostly an operating background, however that’s what makes Insight a unique investor, we bring real world operating experience to our investment and partnership,” Jaffe said.

“A big focus of mine is machine learning applied to real world applications,” Jaffe said. Examples include cybersecurity or fraud detection, which can be used horizontally across industries. Vertical applications include technology developed by Tractable Ltd., which uses artificial intelligence to let insurers estimate damages to, say, a car based on a photo.

The role goes beyond conducting due diligence and providing capital. For a founder of a high-growth technology company, Jaffe said, the choice of investor is in many ways a key hiring decision. “The kinds of founders who are attracted to working with me are those who want to go deep into tech strategy and to work through the challenges involved in sort of scaling something internationally with someone who has been a CEO,” he said.

Among other developments in software, Jaffe is seeing more control investments in high-growth companies, as opposed to strictly minority investments. “Taking control positions in high growth companies is just not that common,” he said. “It’s a trend that we’re noticing and that we’re trying to be a leader in.” An example of the deals, which Insight refers to as growth buyouts, is the firm’s 2020 investment in Armis Inc.

Another trend is equity-based M&A among high-growth startups, such as Aqua Security Software Ltd.’s purchase of fellow cybersecurity company Cloudsploit in 2019.

“It solves a lot of problems,” Jaffe said of the use of equity in combinations of high-growth companies. For starters, it conserves cash during the pandemic.

“Really good companies almost never want to exit,” he added. “If you limit the companies you can acquire to those where the founders and the investors wanted to exit entirely, you’re really down selecting the world of potential companies.“

Unlike a deal in which a startup cashes out or takes a large chunk of equity from a software conglomerate, the equity deals provide staff of smaller merger partners with the opportunity to meaningfully increase the values of their stakes — addressing issues of incentives and retention.

The equity deals also help address valuation issues. “A lot of times startups have really high valuation expectations,” he said. “If you’re an acquirer that’s also a relatively small company, you can put a high valuation on yourself and a high valuation on them.”