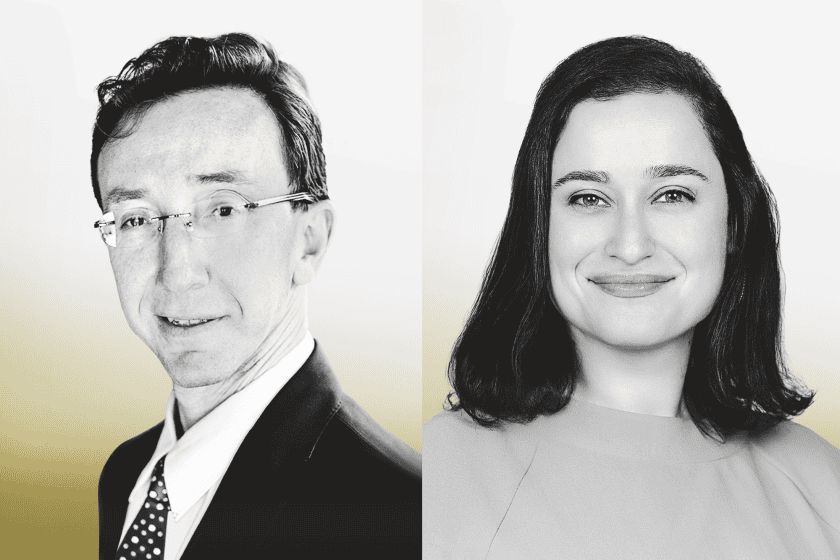

Drinks With The Deal: Wachtell's Kirman, Tetelbaum Discuss Mentorship

After Lina Tetelbaum received an offer to become a summer associate at Wachtell, Lipton, Rosen & Katz in fall 2008, she returned to the firm’s New York office to ask lawyers there why she should choose the firm over another that had made her an offer.

One of the lawyers she met was Igor Kirman, then a young partner at Wachtell. Both Kirman and Tetelbaum are Russian Jewish immigrants, and both had grown up in Queens and graduated from Stuyvesant High School, one of New York’s top public high schools, which created an immediate bond between them.

“There was one question that I had on my mind,” Tetelbaum recalled on this week’s Drinks With The Deal podcast. “I was 24, I was single. I didn’t ask anything about partnership prospects or the nature of the work. I just said, ‘Igor, can you promise me that if I come here, I’m not going to die alone?'”

Kirman’s response: “You might die alone, but it won’t be because you came to Wachtell Lipton.”

Tetelbaum did join Wachtell, and within a few months of starting she was working with Kirman on a complicated, and ultimately successful, hostile takeover defense. Tetelbaum made partner at Wachtell in 2019 and continues to do deals with Kirman, who was also one of the first people to meet Tetelbaum’s now-husband Matt after they started dating. Kirman “gave his blessing” to the relationship, Tetelbaum said.

Listen to the podcast with Igor Kirman and Lina Tetelbaum below:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.