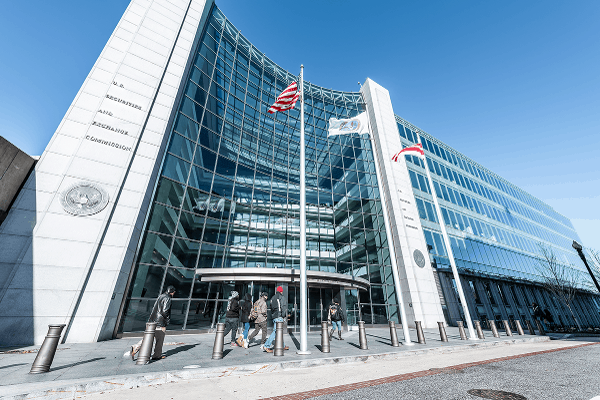

One sentence in the Securities and Exchange Commission’s 141-page draft rule targeting U.S. proxy advisory firms has been raising alarm bells among institutional investors, who have been studying the package of proposals introduced earlier this month.

The proposed rules, if adopted, would require proxy advisers Glass Lewis and Institutional Shareholder Services to give all corporations a chance to review their draft recommendation reports issued by the firms twice before publication, first for up to nine calendar days and then once again, two days before publication.

The SEC proposal is at the center of a power struggle between the two advisers, on the one hand, and U.S. corporations on the other, over often-controversial recommendations to shareholders issued by ISS and Glass Lewis on hedge fund-led director fights, CEO pay plans, blockbuster mergers and environmental, social and political proposals.

The provision of concern notes that the SEC believes that its proposal, if approved, would “establish effective measures to reduce the likelihood of factual errors or methodological weaknesses in proxy voting advice…”

Investors and academics who are critics of the package say they believe that the provision suggests that companies, after viewing draft proxy adviser reports, will be able to challenge the advisers’ methodology even when they cannot find any errors, and that this will allow them to pressure the advisers into changing or at least delaying their recommendations.

“Correcting errors is one thing, but the language around methodological weaknesses is very concerning to us,” said Aeisha Mastagni, portfolio manager at the California State Teachers’ Retirement System. “We want unbiased independent research from proxy advisers and allowing companies to view those reports in advance of them coming to investors could undermine their independence and unbiased research.”

Yet corporations have been urging the SEC to take action, complaining that proxy advisers have conflicts of interest. Critics of ISS point out that the firm provides reports with voting recommendations to institutional investors at the same time that it offers consulting services to corporations. Corporations complain that it is unclear to them exactly what they must do to improve their scores and ratings at the same time that they are under informal pressure to employ ISS’ consulting service for a fee to help them figure it out.

Nevertheless, critics of the new draft proposals contend that corporations will have many opportunities to complain about draft recommendation reports before they are published, which could have the impact of discouraging ISS and Glass Lewis from issuing notes urging investors to vote against a company’s CEO pay packages or on other controversial matters.

Editor’s note: The original version of this article, including advisers and other details, was earlier published on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.

This Content is Only for The Deal Subscribers

If you’re already a subscriber, log in to view this article here.