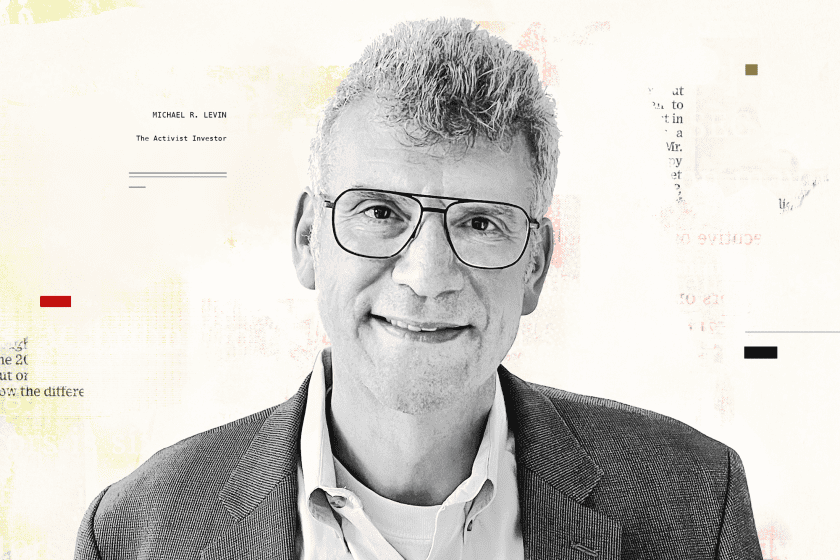

Tesla Inc. (TSLA) would have a very tough time gaining shareholder approval to reincorporate from Delaware to Texas, as CEO Elon Musk is seeking, and the effort would also face litigation in the Delaware Court of Chancery, activist investor and adviser Michael Levin argues.

“Musk can’t just reincorporate without approval from shareholders,” Levin told the Activist Investing Today podcast. “He will need to get approval from a lot of shareholders that are interested in preserving their rights. Many shareholders will look to Delaware to defend their rights at Tesla. I would be skeptical that Tesla would win a shareholder vote to relocate out of Delaware.”

A shift in incorporation would likely require a change to Tesla’s charter, which requires approval from 66.67% of shares. In a conversation about Tesla, Musk, shareholder voting power and governance, Levin argued that “any one of a number of shareholder plaintiffs and law firms” would love to handle a case challenging the decision to relocate Tesla based on how it diminishes shareholder rights.

Levin discussed his appearance in October in the Court of Chancery to raise concerns about what he views as a loophole in a proposed settlement requiring Tesla directors to return more than $735 million in stock awards and cash to the electric vehicle maker. Levin said he’s seeking to toughen up a provision in the agreement providing for a shareholder vote on what directors pay themselves for a period of five years, to ensure the requirement is binding, not precatory. Shareholders already typically have a nonbinding annual vote on executive pay at U.S. corporations, dubbed “say on pay.”

“This [potentially binding shareholder vote] represented an interesting and potentially unprecedented change in how shareholders relate to boards and directors,” Levin said. “The idea of directors being able to approve what their elected representatives get paid has never happened before. It would provide an enormous amount of authority for Tesla shareholders over the board.”

Check out the podcast with Michael Levin below:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.