About a week before Engaged Capital LLC launched an activism campaign in October urging VF Corp. (VFC) to consider divestitures, a group of students at the University of Pennsylvania Law School enrolled in the school’s Shareholder Activism course identified the apparel and footwear company as a possible activist target.

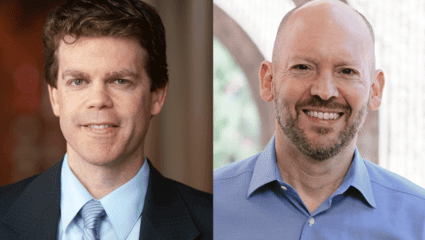

“They found VF Corp. on their own and then Engaged came out with their deck at a conference,” said Dan McDermott, a lecturer at Penn who created an activist investing class in 2021.

McDermott, an executive at communications firm ICR Inc., said he started the course after realizing that much of the subject matter involved in the world of activist investing wasn’t being taught in U.S. M.B.A. programs and law schools. The course is among a number of activist courses popping up at top business and law schools in the U.S.

“I have an M.B.A., and this subject material was not covered when I was in grad school, and I thought the topic goes over a lot of ground, including negotiation, business law, corporate finance, corporate governance and many ESG topics, and I pitched it to a couple schools in the Washington, D.C., area, and then Penn and Penn Law School,” McDermott said.

Activist U’s Growing Enrollment

- Columbia University – “Shareholder Activism as a Value Strategy” course (started in 2021)

- New York University – “Activist Investing” course (2022)

- Syracuse University – “Activist Investing and Corporate Governance” program (2022)

- University of Pennsylvania:

- Law School’s “Shareholder Activism” course (2021)

- Wharton School’s “Shareholder Activism and Corporate Governance” (executive education, four-day, nondegree program)

McDermott’s class in 2023, a group of 28 students, includes law and M.B.A. students in University of Pennsylvania’s Wharton School, and students seeking a combination J.D. law and M.B.A. degree.

In the program, students compared public companies to their peers over one-, three- and five-year intervals, from a shareholder-return point of view. They also reviewed capital allocation, performance and growth topics and presented campaigns about companies.

“At the end of each semester, five or six students will have a go at making a presentation from the activist point of view,” he said. “They identify opportunities for strategic and operational improvements; sometimes it is an M&A thesis, and they think the multiple is down and the company should be acquired, and these are the directors that should resign. They pick real companies, and they mimic advisers working on a campaign.”

Top activists and advisers have volunteered their time as guest lecturers.

Editor’s note: The original, full version of this article was published Feb. 2, 2024, on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.

This Content is Only for The Deal Subscribers

If you’re already a subscriber, log in to view this article here.