The largest U.S. proxy adviser, Institutional Shareholder Services Inc., late Thursday, Oct. 31, filed a lawsuit in a key D.C. court charging that guidance the nation’s securities regulator issued in August is “unlawful.”

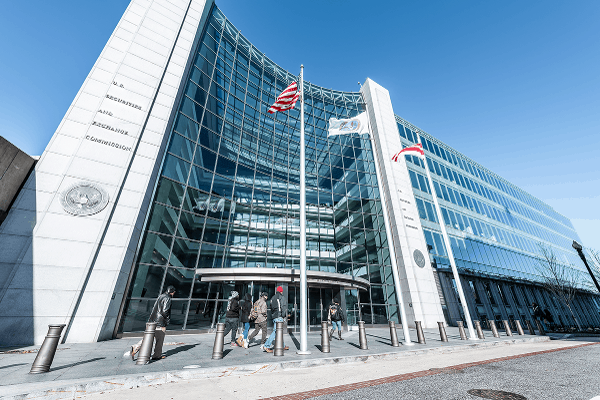

At issue is guidance issued by the Securities and Exchange Commission for investors using the services of proxy advisers ISS and Glass Lewis & Co. LLC. The two firms issue often-controversial recommendations to shareholders on hedge fund-led director fights, CEO pay plans, blockbuster mergers and environmental, social and political proposals.

At the center of the lawsuit, filed in the U.S. District Court for the District of Columbia, is a provision in the SEC guidance noting that proxy voting advice provided by proxy advisers generally constitutes a “solicitation” under the federal proxy rules. The lawsuit argues that the provision of proxy advice is not a proxy solicitation and cannot be regulated as such. In addition, ISS argues that the SEC should have followed its rule-making approach, which includes proposals and a vote of commissioners, rather than quickly releasing guidance on the issue.

Editor’s note: The original version of this article, including advisers and other details, was earlier published on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.

This Content is Only for The Deal Subscribers

If you’re already a subscriber, log in to view this article here.