TDE Middle Market: Activists Eye Pay During Covid

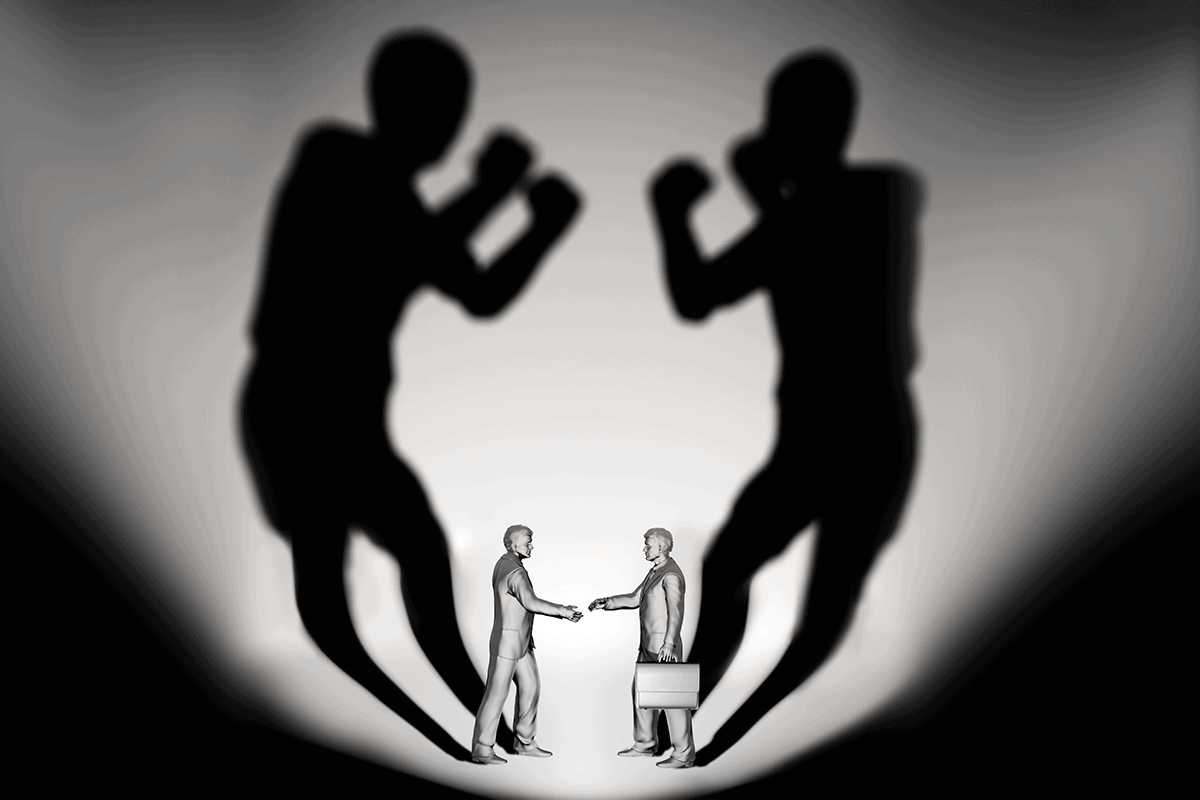

Activists are preparing to call the bluff of middle-market companies unprepared for the coronavirus due to cozy relationships between board and management teams and bloated pay for top company executives.

Truly independent boards that hold management accountable trade at a results-based premium to entrenched and beholden boards, while bad boards reveal themselves when a crisis hits for which they’re ill-prepared.

“We’ve seen so many companies that have interlocking directors, they’re on each other’s boards,” said Jim Mitaratonda of Barington Capital Group on an activist panel Monday, July 27, during The Deal Economy: Middle Market Week digital event. “How do you challenge someone like that? We want to make sure that the directors properly align compensation with value creation.”

Mitaratonda joined Spruce Point Capital Management founder and chief investment officer Ben Axler, Snow Park Capital Partners managing partner Jeffrey Pierce and Coast Capital Management partner and CIO James Rasteh on that panel, “Middle Market Activism Amidst Covid-19.”

Cozy business and social connections among the C-suite and the board is just one alert that a company may become a target. Tone-deaf corporate behavior in the face of their average employee’s struggles during the pandemic is also catching activists’ eyes.

The former can indicate a board too closely aligned with the CEO to challenge the role and less cognizant of its fiduciary responsibility.

As to the latter, hundreds of companies have reduced their CEO compensation amid the pandemic, but many others have not.

Rasteh said: “I think [for] CEOs of companies that are furloughing employees, [it is] crucial to take as drastic a salary cut as you can. Frankly, it’s the mark of leadership.”

There were some high-profile middle-market companies targeted with activist campaigns related to say on pay this year.

The most prominent example was USA Technologies Inc., where Doug Braunstein’s Hudson Executive Capital launched a change of control proxy contest and ultimately took control of the company’s board. USA Technologies has received the worst vote on pay of 2020 so far, with an 84% vote against.

Executive pay and board composition were hot activist issues for the past several quarters. Most observers agree a negative vote approaching or hitting 20% on either metric is blood in the water for the activist community. The trend can be seen both in large-cap and middle-market companies.

At S&P SmallCap 600 companies, specifically, 128 directors have received less than 75% support in 2020 so far, and 17 of those got majority negative votes, according to data compiled by Proxy Insight. In addition, 38 companies in the S&P SmallCap 600 index received a majority negative vote on executive pay.

Though the market volatility induced by the pandemic curbed activism in the first half, Monday’s panel agreed that activism would continue and that the market sell-off has exposed some companies that may have been coasting along during the highs of 2018 and 2019.

Editor’s note: The original version of this article was published earlier on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.