The outcome of the November election is on many people’s minds, but dealmakers are still much more worried about the Covid-19 pandemic than they are about who sits in the White House come Jan. 20.

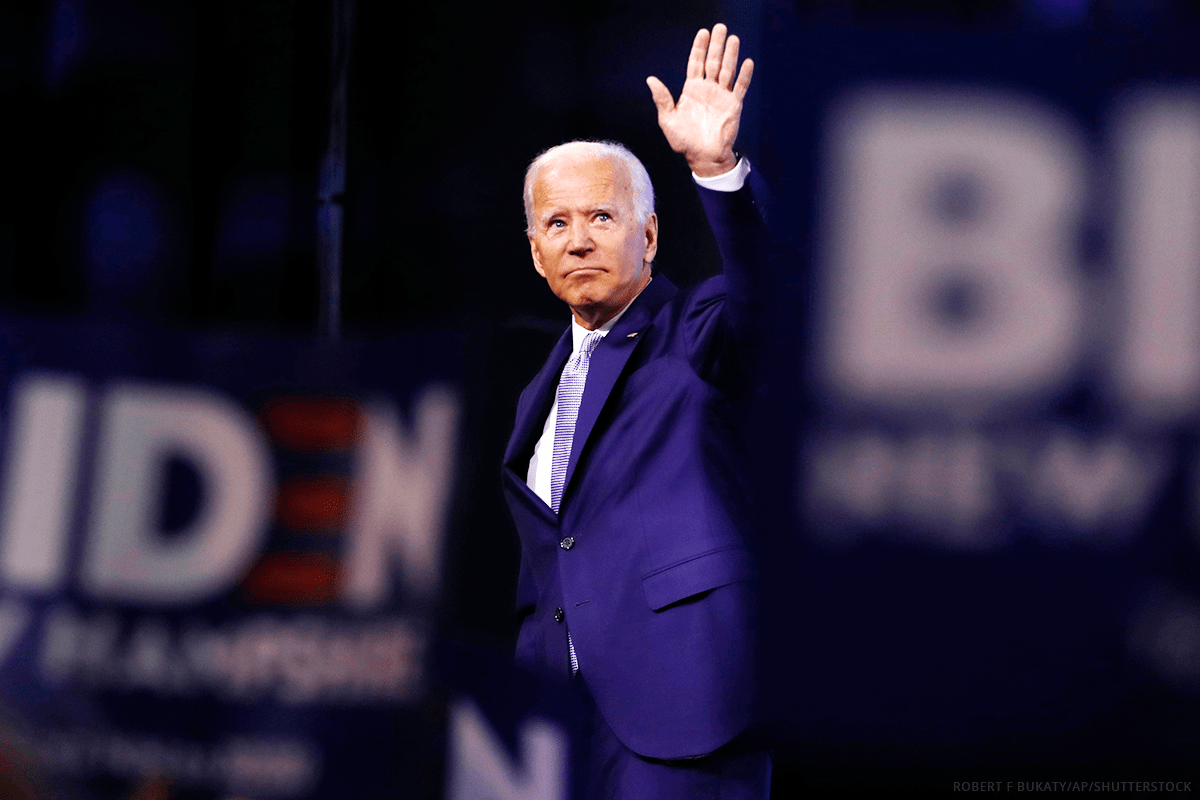

“Covid and the timing of a vaccine is going to have a much bigger impact on dealmaking and economic activity in 2021 than whether we have one of two different septuagenarian white men in the White House,” One Equity Partners LLC managing director Andrew Dunn said. “They have rather different political views, but it will take time, as it always does, for things to shift in terms of tax policy and everything else.”

Unlike the election, the coronavirus crisis continues to have effects on how dealmakers go about doing business with 2021 in mind. That was the overwhelming sentiment portrayed by a panel hosted Monday, Sept. 22, by senior reporter Steve Gelsi as part of The Deal Economy: Predictions and Perspectives virtual event.

“Hopefully, we will be in a place where we’re in a post-Covid world in 2021 and we have a vaccine and children can go back to school,” Oaktree Capital Management LP’s Amy Rice said during the panel.

Rice, a managing director at the distressed debt investor, said the post-Covid world will present different opportunities than the world pre-coronavirus for the firm.

“Regardless, the world will have changed, and navigating investing in that post-Covid world will continue to present distressed opportunities,” she said. “As a result, figuring out valuations and business models that work in the post-Covid world is where I think there is going to be continued opportunities for an investor like ourselves.”

To be sure, the November election is playing some role in near-term dealmaking.

“I think near term we’re hearing there are going to be effects, at least through the year end,” said Lara Banks, a managing director at Makena Capital Management LLC, an asset manager with $20 billion in assets under management. “We’ve seen a few deals, co-investments, where people are trying to sell before tax changes.”

Nevertheless, the broader focus remains firmly on how to invest in a way that best sets your firm up for a post-crisis recovery.

“One of the lessons learned from the last crisis is it is important to keep a focus on medium- to long-term value creation,” Eurazeo SE managing director Vivianne Akriche said during the panel. “A question for us, as we think about putting money to work, especially in portfolio companies who were doing well before Covid, is trying to understand whether a business is structurally impaired or not. And when it’s not the case, it’s important to continue to invest … giving the means to a management team, to a company, to go through this crisis and not jeopardizing the long-term value creation.”

Editor’s note: The original version of this article was published earlier on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.