Endeavor Group Holdings Inc. (EDR) used Justin G. Hamill, Michael V. Anastasio, Jonathan P. Solomon and Ian A. Nussbaum of regular counsel Latham & Watkins LLP for legal advice on an agreement to combine its UFC franchise with World Wrestling Entertainment Inc. (WWE) announced Monday, April 3, in a deal that values the combined entity at $21.4 billion. Endeavor will hold a 51% interest in the new company, while WWE shareholders will own 49%.

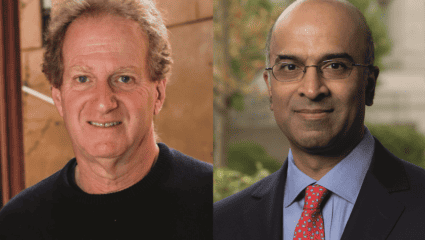

Brian Stearns at Morgan Stanley and Kim-Thu Posnett and David Ludwig at Goldman, Sachs & Co. gave financial advice to Endeavor, a Beverly Hills, Calif.-based entertainment content company where chief legal officer Seth Krauss and deputy general counsel Robert Hilton worked on the deal.

In 2012, Hamill advised William Morris Endeavor Entertainment LLC when Silver Lake Partners LP bought a 31% stake in the talent agency. The next year, he worked with WME when it bought IMG Worldwide Holdings Inc. from Forstmann Little & Co. for $2.4 billion. Hamill then counseled WME IMG Holdings LLC when it teamed with KKR & Co. (KKR) and MSD Capital LP to buy a majority stake in Ultimate Fighting Championship in 2016.

The next year, WME IMG assumed the name Endeavor, for which Hamill has done a number of deals, including its 2021 IPO, where Hamill and Latham’s Marc D. Jaffe, Ian D. Schuman and Benjamin J. Cohen were issuer counsel, and its $1.2 billion purchase of OpenBet from Light & Wonder Inc. (LNW) in 2022.

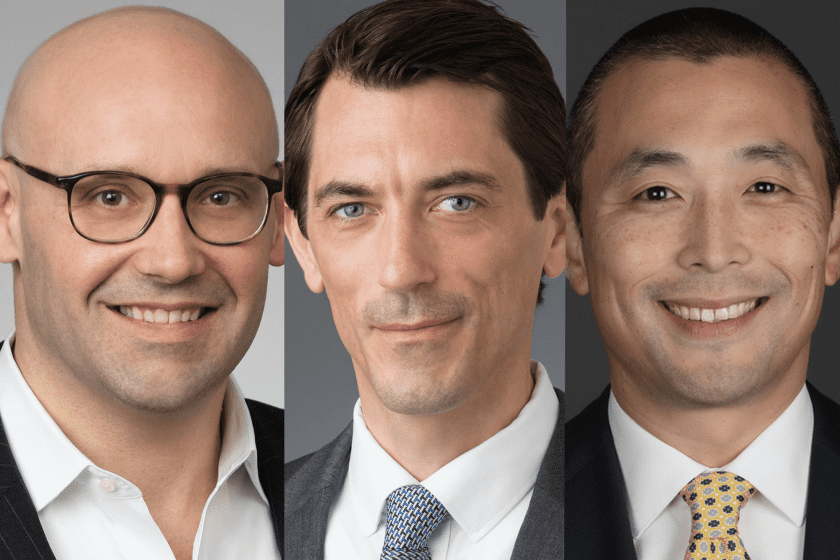

Kyle T. Seifried and Scott A. Barshay of Paul, Weiss, Rifkind, Wharton & Garrison LLP advised Stamford, Conn.-based WWE, whose controlling shareholder and executive chairman Vincent K. McMahon tapped Edward J. Lee, Jonathan L. Davis and Chelsea N. Darnell of Kirkland & Ellis LLP.

McMahon announced in January that he had tapped Kirkland for counsel on a strategic review process launched in conjunction with WWE’s upcoming media rights negotiations. The Deal reported then that World Wrestling Entertainment could seek a deal with Endeavor to combine WWE with Endeavor’s UFC broadcasting rights.

Jeffrey A. Sine and Christopher Donini at Raine Group LLC were lead financial adviser to WWE, which also took financial advice from Marco Caggiano, Paul Finger and Benjamin Berinstein at JPMorgan Securities LLC and Navid Mahmoodzadegan, Carlos Jimenez and Daniel Lee at Moelis & Co. LLC.

The in-house legal team on the deal at WWE included chief legal officer Maurice Edelson, deputy general counsel James Langham and vice president – business and legal affairs Viviana Marcela Betancourt.

The new entity’s 11-member board of directors will include six members appointed by Endeavor and five by WWE. The companies expect to close the deal in the second half of 2023.

The original version of this article was published earlier on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.