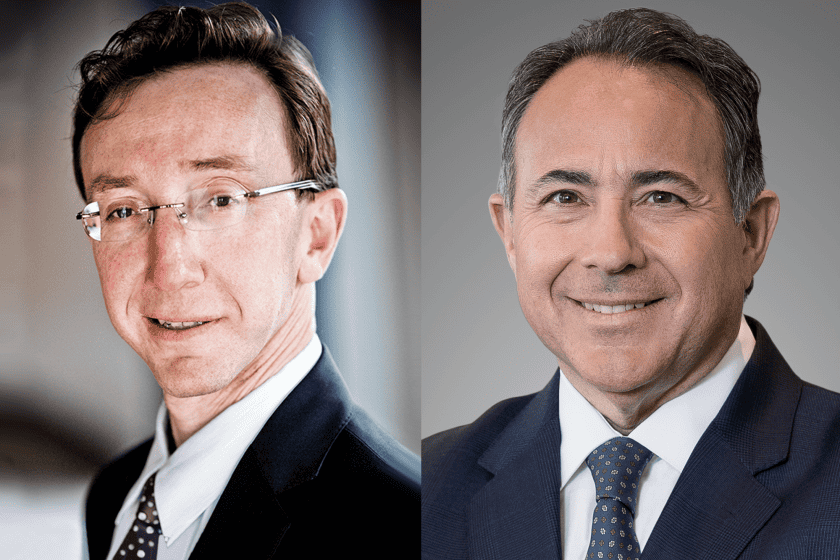

NuStar Energy LP (NS) turned to Igor Kirman and Zachary S. Podolsky of Wachtell, Lipton, Rosen & Katz and George J. Vlahakos, Angela T. Richards and Tanner L. Groce of Sidley Austin LLP for counsel on an agreement to sell to Sunoco LP (SUN) for $7.3 billion in stock and assumed debt announced Monday, Jan. 22.

Nelson Mabry, Steve Miller and Gary Posternack of Barclays gave financial advice to NuStar, a San Antonio-based pipeline and liquids terminal operator where CEO Brad Barron and general counsel Amy Perry were on the deal.

Kirman and Vlahakos advised NuStar on the 2018 simplification of its master limited partnership structure. Vlahakos counseled the company on its sale of eight storage terminal locations to Sunoco for $250 million in 2021. and with Groce represented NuStar on a $223 million stock offering in August.

Sunoco turned to Michael J. Aiello and Sachin Kohli of Weil, Gotshal & Manges LLP and Lande A. Spottswood, Jackson A. O’Maley and E. Ramey Layne of Vinson & Elkins LLP for counsel. Truist Securities Inc. gave financial advice to Dallas-based Sunoco, which distributes motor fuel and owns refined product transportation and terminal assets. Truist and Bank of America Corp. provided committed financing for the deal.

CEO Joe Kim, senior vice president of finance Scott Grischow and general counsel Arnold D. Dodderer worked on the deal at the buyer.

Spottswood advised Sunoco on a $1 billion agreement to sell 204 stores to 7-Eleven Inc. announced Jan. 11, and V&E was issuer’s counsel for Sunoco’s $500 million private offering of senior notes in September. Spottswood and V&E’s Matt Strock counseled Sunoco on the 2018 sale of 1,030 convenience stores to 7-Eleven for $3.3 billion.

NuStar common unitholders will receive 0.4 Sunoco shares for each NuStar common unit, a 24% premium based on the companies’ 30-day volume-weighted average prices as of Jan. 19. The companies plan to close the deal in the second quarter of 2024 pending approvals by regulators and NuStar’s unitholders.