Twitter Inc. (TWTR) tapped longtime counsel Wilson Sonsini Goodrich & Rosati PC on its $44 billion agreement to sell to an entity owned by Elon Musk that was announced Monday, April 25.

Wilson Sonsini’s Martin Korman, Douglas Schnell, Remi Korenblit and Katharine A. Martin teamed with Alan M. Klein, Anthony Vernace and Katherine Krause of Simpson Thacher & Bartlett LLP to represent the social media company.

The San Francisco-based target looked to Gene Sykes, Sam Britton and Kim-Thu Posnett at Goldman, Sachs & Co.; Marco Caggiano, David Freedman, Noah Weintroub and Eric Menell at JPMorgan Chase & Co. along with Allen & Co. LLC for financial advice.

Wilson Sonsini’s Martin, Steven Bochner and Rezwan D. Pavri were counsel on the company’s 2013 IPO, on which Goldman, Morgan Stanley and JPMorgan were the lead underwriters. Wilson also advised Twitter on its $1.05 billion sale of MoPub Inc. to AppLovin Corp. (APP), a deal announced Oct. 6 and closed on Jan. 1.

Klein and Vernace and Goldman’s Britton and Dan Dees are working with longtime client Microsoft Corp. (MSFT) on its pending $68.7 billion agreement to buy Activision Blizzard Inc. (ATVI), a Santa Monica, Calif.-based online game developer, a deal announced Jan. 18.

In house, Twitter’s policy and safety lead director and chief legal officer Vijaya Gadde and general counsel Sean Edgett worked on the deal. Gadde practiced at Wilson Sonsini from 2000 to 2010, when she moved to Juniper Networks. She joined Twitter in 2011 as director-legal and became general counsel two years later.

Musk used Michael S. Ringler, Sonia K. Nijjar and Dohyun Kim of Skadden, Arps, Slate, Meagher & Flom LLP for counsel and Michael Grimes, Anthony Armstrong and Owen O’Keeffe at Morgan Stanley as lead financial adviser. BofA Securities Inc. and Barclays plc also gave financial advice to Musk. Nijjar and Skadden’s Kenton King advised Activision on the Microsoft deal.

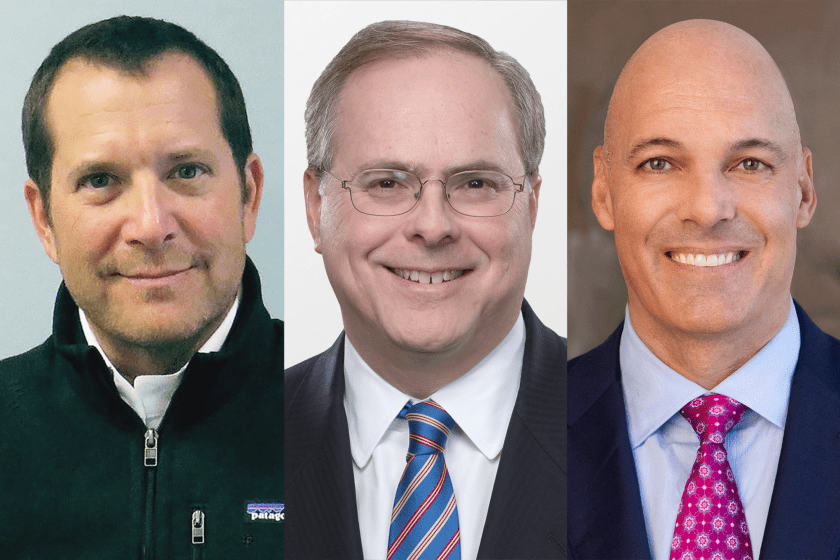

Davis Polk & Wardwell LLP is advising Morgan Stanley and the other banks that are providing $25.5 billion of fully committed financing to fund the deal. Davis Polk’s James A. Florack and and Sanders Witkow led on the $13 billion leveraged financing loan that Twitter will take on, while the firm’s John Brandow led on the $12.5 billion margin loan that the Musk entities are taking on. Skadden’s Steven Messina and Tracey L. Chenoweth are advising Musk on the financing.

The margin loan is backed by part of Musk’s stake in Tesla Inc. (TSLA). Musk is also putting in $21 billion in equity.

Editor’s note: The original version of this article was published earlier on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.