The M&A market boomed in 2021. U.S. activity was at record levels in terms of both number and aggregate value of deal, with private equity, technology and financial institutions dealmaking all at their highest levels since at least 2008.

Perhaps the most noteworthy aspect of dealmaking last year was the resurgence of financial institutions M&A, especially among commercial banks. That sector was a pillar of the M&A market from the 1980s to 2008, when regulators effectively called a halt to the consolidation in the wake of the Great Financial Crisis.

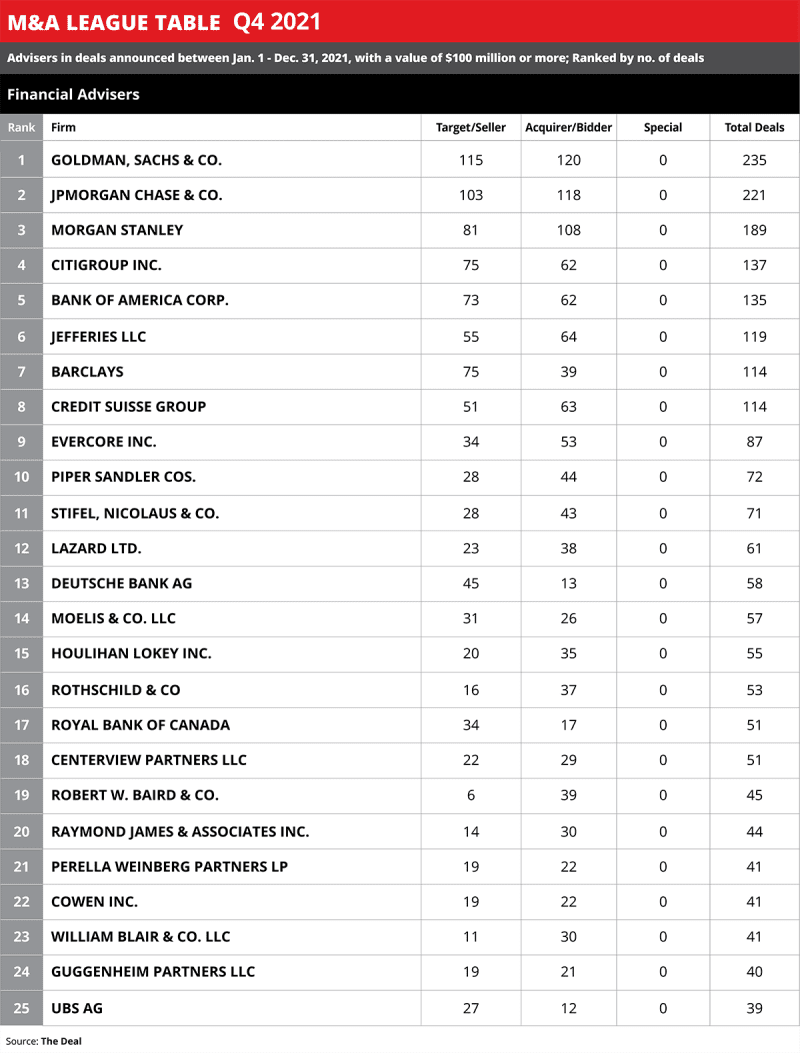

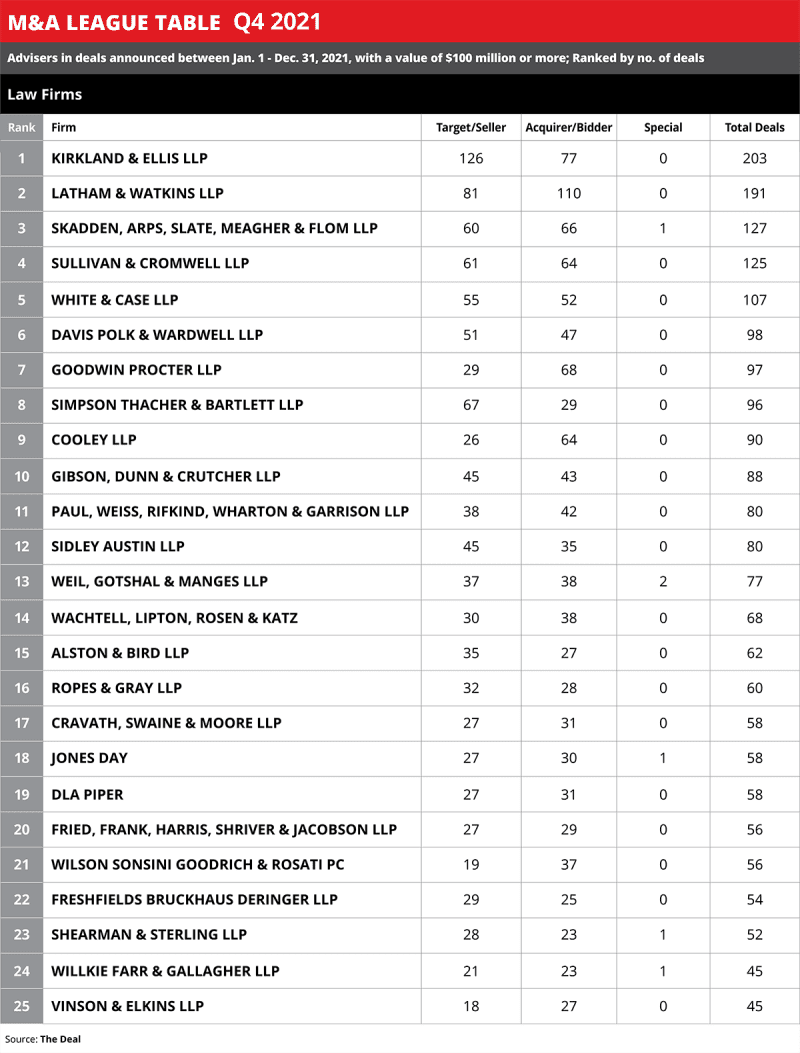

But FIG M&A boomed last year, with the largest deal in the sector being BNP Paribas SA’s $16.3 billion agreement to sell Bank of the West Inc. to Bank of Montreal, which was announced in December. BNP tapped Sullivan & Cromwell LLP, which finished fourth in The Deal’s adviser rankings for the fourth quarter of 2021, while BMO used Wachtell, Lipton, Rosen & Katz, which finished 14th but was on eight of the 20 largest deals of the year.

Tech dealmaking was also red-hot, which in part reflects the ubiquity of tech in all sectors of the economy. Consider the largest tech deal signed up by a strategic in Q4, Emerson Electric Co.’s (EMR) $11 billion agreement to buy Aspen Technology Inc. (AZPN), which turned to Skadden, Arps, Slate, Meagher & Flom, third in our rankings, while Emerson, historically a manufacturing company that is buying Aspen for its software and services expertise, used Davis Polk & Wardwell, sixth in our rankings.

Healthcare dealmaking was also robust even if the sector didn’t see a truly massive combination this year. But the largest merger in the sector signed up by a strategic showed how tech and healthcare are coming together as Oracle Corp. (ORCL) agreed to pay $28 billion for healthcare IT company Cerner Corp. (CERN), which turned to Latham & Watkins (No. 2 in our rankings) for counsel, while Oracle used Hogan Lovells (No. 34), with Kirkland & Ellis LLP (No. 1), as antitrust counsel.

Kirkland was also on the buy side of the three biggest deals signed up by private equity sponsors in Q4, advising Bain Capital LLC and Hellman & Friedman LLC on a $17 billion agreement to buy Athenahealth Inc. from Veritas Capital Fund Management LLC, Evergreen Coast Capital Corp. and KKR & Co. Inc. and Global Infrastructure Partners on a $15 billion deal for CyrusOne Inc. (CONE) and acting as financing counsel to Advent International Corp., Permira Advisers LLC, Crosspoint Capital Partners, Canada Pension Plan Investment Board, GIC Pte. Ltd. on a $14 billion agreement to buy McAfee Corp. (MCFE).

Editor’s note: The original version of this article, including additional rankings for Delaware law firms, proxy solicitors and public relations firms, was published earlier on The Deal’s premium subscription website.

More League Tables are also available for Bankruptcy, Restructuring and Private Equity. For access, log in to TheDeal.com or use the form below to request a free trial.

This Content is Only for The Deal Subscribers

If you’re already a subscriber, log in to view this article here.