Welbilt Inc. (WBT) agreed to sell its Manitowoc ice business to Pentair plc (PNR) for $1.6 billion in cash in a deal announced Thursday, March 3.

Welbilt, a New Port Richey, Fla.-based foodservice equipment business, expects to close the deal with Pentair at the same time as it closes its $4.8 billion sale to Ali Holding Srl. Pentair expects to fund the deal by issuing investment-grade debt.

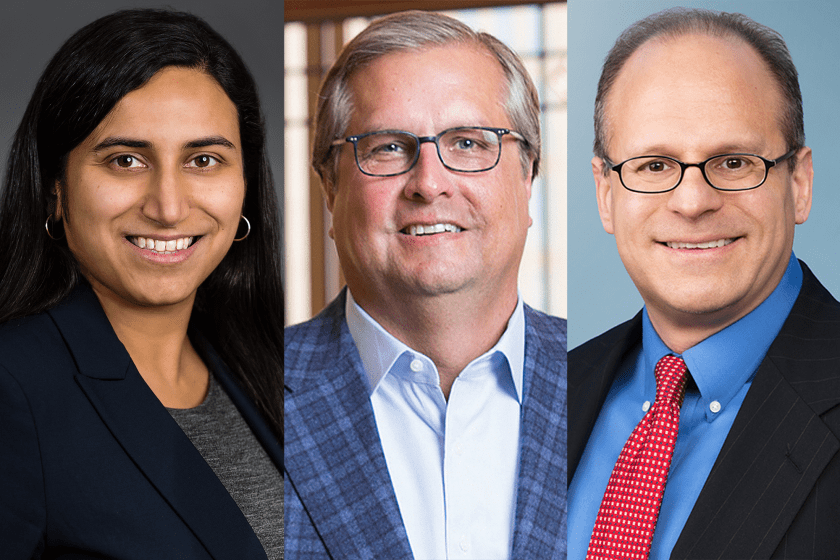

Welbilt turned to Saee Muzumdar of Gibson, Dunn & Crutcher LLP and C. Mark Kelly and Justin R. Howard of Alston & Bird LLP for counsel and Chris Gallea, Paolo Battaglia and Brian Biga at Goldman, Sachs & Co. for financial advice. General counsel Joel H. Horn and associate general counsel Betty Berklee and Christian Link are working on the deal in-house at Welbilt. Muzumdar and Gibson Dunn’s Barbara L. Becker and Boris Dolgonos advised Welbilt on the deal with Milan-based Ali, which tapped Alston & Bird and Goldman.

Pentair, a water treatment company based in Arden Hills, Minn., turned to Michael Stanchfield and Kate Sherburne of Faegre Drinker Biddle & Reath LLP for counsel and Charles Dupree, Zohar Keller and Charles Bouckaert at JPMorgan Securities LLC for financial advice. John Wilson, Heidi Furlong and Sarah Null at Foley & Lardner LLP are advising Pentair on the debt. Pentair general counsel Karla Robertson and associate general counsel Lance Bonner worked on the deal at the company. Robertson practiced at Faegre Drinker’s predecessor from 2000 to 2005, when she went in-house at Target Corp. (TGT) She moved to Supervalu Inc. in 2009 and to Pentair in 2017, while Bonner was at Faegre from 2017 to 2020, when he joined Pentair. JPMorgan is underwriting the debt as well; Zulf Bokhari, Stelios Saffos, and Peter Sluka of Latham & Watkins LLP are advising JPM in that role.

Faegre Drinker advised Pentair last year on its $255 million purchase of Pleatco LLC from Align Capital Partners LP and on its $120 million purchase of Enviro Water Solutions LLC from Trivest Partners LP in 2019.

Foley represented Pentair on its purchases of Aquion Inc. from Mason Wells Inc. for $160 million in 2019 and of Erico Global Co. for $1.8 billion in 2015 as well as on the $3.15 billion sale of its valves and controls business to Emerson Electric Co. (EMR) in 2017.

Editor’s note: The original version of this article was published earlier on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.

This Content is Only for The Deal Subscribers

If you’re already a subscriber, log in to view this article here.