When Forescout Technologies Inc. (FSCT) filed suit in May to hold Advent International Corp. to its $1.9 billion privatization acquisition, shares of the cybersecurity company fell sharply.

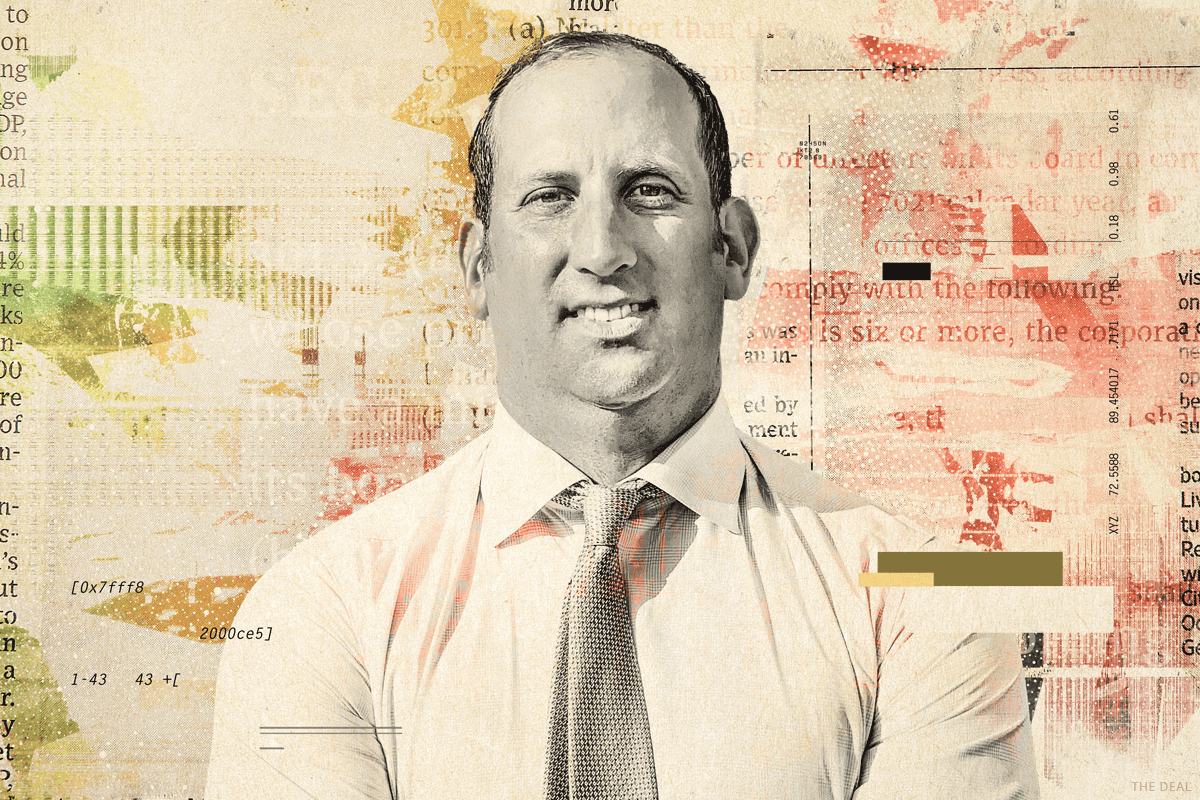

Watching closely was Spruce Point Capital Management LLC’s Ben Axler, an activist short seller, who appears on The Deal’s latest installment of the Activist Investing Today podcast. In the interview he talks about why it became obvious to him much earlier that the deal “didn’t reflect the high probability that the transaction could be renegotiated.”

“Forescout struck a deal with Advent before the [World Health Organization] had declared Covid a pandemic,” Axler said. “We took a look at all the deals that had been announced in January, February and early March, when the market was robust and valuations were rich, and it became obvious to us after reviewing Forescout’s business that there was certainly room for that share price to come down to reflect the new reality. Our projections were more pessimistic than the projections indicated in the proxy statement that Forescout gave to investors.”

Axler also spoke about activism in the middle market, his latest campaign at Prestige Consumer Healthcare Inc. (PBH) as well as Spruce Point’s “forensic” approach to activism, which includes running background checks on executives and directors as well as working with private investigators.

“We try to identify companies that use aggressive financial presentation accounting methods, poor governance and misalignments with shareholders and, in extreme cases, try to find companies that are misrepresenting their products — and in the most extreme cases trying to commit some fraud,” Axler said. “We’re looking for areas where management or board members have omitted key aspects of their bios that would have led investors to see that they failed in prior business efforts.”

Axler is also set to participate on The Deal’s “Middle-Market Activism Amidst Covid-19″ webcast on July 27 at 1 p.m. The short-seller insurgent will join Barington Capital’s Jim Mitarotonda, Snow Park Capital Partners LP’s Jeffrey Pierce and Coast Capital LLC’s James Rasteh, all of whom will offer their thoughts on the changing tactics of activist managers facing coronavirus-driven challenges.

Here’s the Podcast:

Check out more Activist Investing Today podcasts featuring the panelists:

- Rasteh explains his campaign at transport and school bus company FirstGroup

- Barington’s Mitarotonda talks about his private equity approach to public market activism

- Pierce discusses his experiences investing in Australian companies

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.