Elliott Management Corp.’s Paul Singer put up an “epic battle” that exposed a massive divide between people who support companies like Samsung Electronics Co. Ltd. and those who are opposed to generational succession in South Korea.

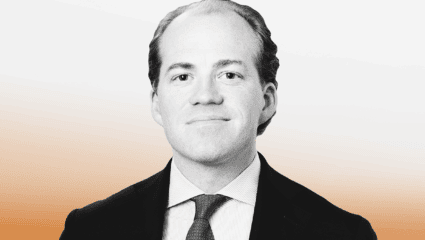

That’s the view of Geoffrey Cain, author of a new book “Samsung Rising: The Inside story of the South Korean Giant That Set Out to Beat Apple and Conquer Tech.”

Cain spoke to The Deal for its Activist Investing Today podcast about South Korea’s chaebols, the biggest swing vote in South Korea and activist investing in Asia. He provided exclusive behind-the-scenes analysis of Samsung’s media, retail and institutional investor campaign to defeat Elliott Management and complete its 2015 merger with Cheil Industries Inc., the holding company for the Samsung empire, a transaction that lead to a massive corruption scandal in Korea.

“The reality was that they were trying to consolidate shareholder value and control under [Samsung heir] Jay Lee to help him raise money to pay his massive inheritance tax,” Cain said. “The three Samsung Lee children will probably pay a $6 billion inheritance tax combined.”

Cain also talks about how the political and economic fallout of the Samsung restructuring impacted Elliott’s subsequent campaigns at Hyundai in 2018 and 2019. He also discusses the outlook for activist campaigns in South Korea.

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.