Environmental activists should target CEOs, corporate boards and energy company shareholders — not oil pipeline construction crews.

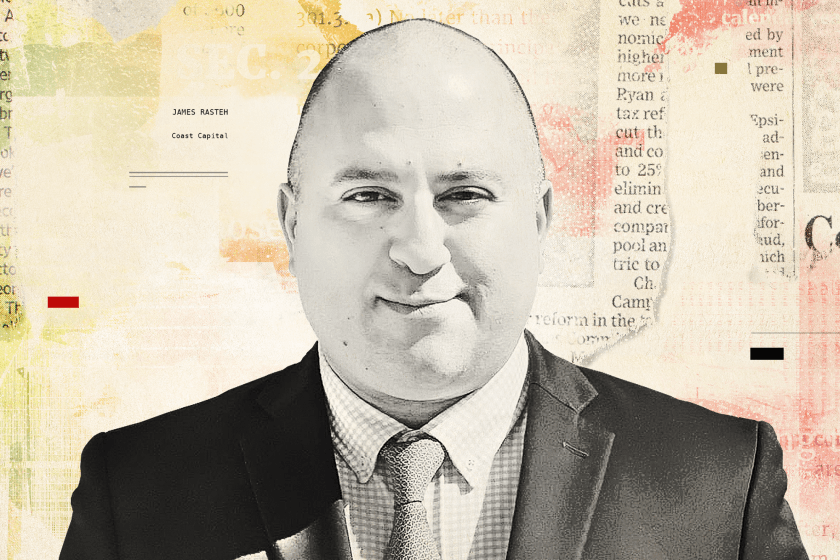

That’s according to Coast Capital LLC’s James Rasteh, who on the latest edition of Activist Investing Today talks about environmental activism, his campaigns targeting Canadian gold miners and why Europe is “grossly misunderstood” and much more friendly for activism than the U.S.

“I find it really stupid that people go and protest the Keystone XL pipeline by disrupting the work of the construction crew that has absolutely no discretion over the project,” Rasteh said, referring to environmentalists seeking to discourage TC Energy Corp.’s (TRP) effort to build the Canada-U.S. Keystone XL pipeline. “The [person] you should be going after is the CEO … or going after the board members. Go after their shareholders. That’s how you put real pressure on the system.”

Rasteh also discussed his ESG strategy for Canadian gold mining companies and why he expects significant consolidation in the industry. He also talked about why mining corporations with clubby boards will “rue the day” they tried to get away with doing “nonsensical” things.

“There has never been an industry that I have happened upon that has been as thickly brushed with a paint of clubby board discount as the gold mining sector in Canada,” Rasteh said.

Rasteh also made the case for activist investing in Europe, arguing that less capital has been deployed in various European jurisdictions at the same time that many more companies “need intervention.”

“Across most jurisdictions, there are no staggered boards, companies don’t have golden shares, often don’t have golden parachutes that can muddy the waters for a lot of activist investors,” he said. “And in countries like the U.K., with a 5% stake in a company you can call an [extraordinary general meeting]; certainly can’t do that in the U.S.”

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.