Activist Investing Today: Columbia’s Coffee on WeWork, Softbank and IPO Ratchets

Retail investors are being harmed by essentially secret IPO protection deals still-private companies are reaching with mutual funds.

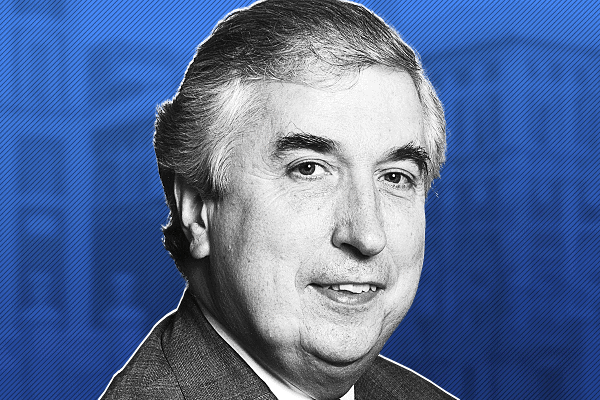

At least that’s the view of Columbia Law School professor John Coffee, who spoke with The Deal for its Activist Investing Today podcast about so-called IPO ratchets — contracts some mutual funds are receiving entitling them to additional shares in the event an initial public offering falls below the valuation reflected in the final private equity round.

In a wide-ranging conversation, Coffee explained that public investors can suffer dilution while the IPO itself is at risk of becoming overpriced. He argued adequate disclosure of the details of these ratchets could discourage their use.

On the podcast, Coffee offered shocking details of what a particular ratchet would have given Softbank Group Corp. had WeWork Cos. debuted earlier this year. He also argued WeWork share ownership and voting structure produced a particularly egregious example of why it is dangerous to give a founder, in this case ex-CEO Adam Neumann, too much power.

“This is the most extreme illustration of what can happen when you lock up control in this fashion,” Coffee said.

Congress or the Securities and Exchange Commission, however, won’t ban these kinds of dual-class share structures giving founders control anytime soon, Coffee said.

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify, and on TheDeal.com.