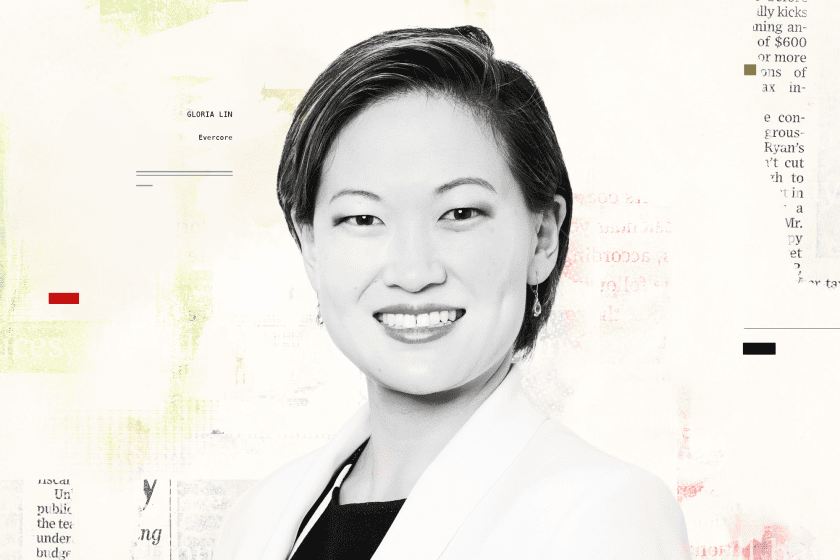

White squire PIPE investments can be a “potentially attractive” defense against an activist agitating against a deal or running a campaign at a company, Evercore Inc. managing director Gloria Lin said on the latest Activist Investing Today podcast.

More often than not, however, Evercore “cautions against” taking a PIPE investment when facing an activist.

“Unless there is a clear business purpose, such as to fund M&A or to fund R&D, it is hard to justify the need, really for all your shareholders,” Lin said. “That’s not to say we haven’t had clients in the past that have actually implemented a PIPE when there have been activists involved.”

She added that PIPE investments from well-known PE investors can give a “stamp of approval” for value creation at the company, but corporations should be aware that a friendly PIPE investor “might not be quite as supportive of the strategy” down the road.

Beyond white squire infusions, Lin discussed governance, so-called “bad deals” and trends in M&A activism amid a cooling deal market.

Check out the podcast with Gloria Lin below:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.