Credible “economically motivated” activists won’t target corporations with poor governance or problematic CEO pay unless they have a broader M&A or operational goal in mind.

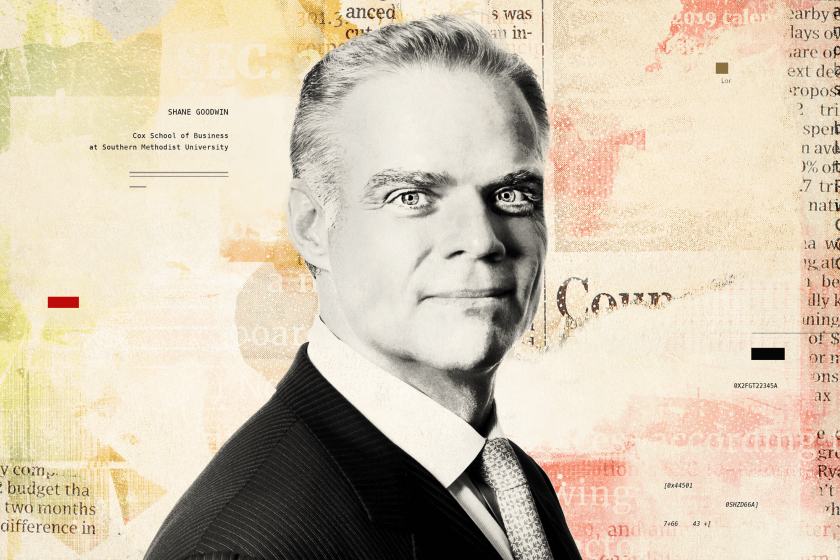

That’s according to Shane Goodwin, managing director of the Applied Corporate Governance Institute at the Center for Global Enterprise. Goodwin spoke with The Deal for its Activist Investing Today podcast about stakeholder capitalism, predictive stewardship vulnerability scores and why he believes a campaign targeting CEO pay is a “means to an end.”

“You won’t get credible economically motivated activists, looking to make a good return, going out of their way on a one-off basis to target a company to get them to fall in line with better compensation,” Goodwin said. “It is a means to an end. It creates tension and a wedge issue in the boardroom. Ultimately, these companies are often underperforming and perhaps there is an opportunity to force it into a sale.”

In addition, to compensation issues, Goodwin argued that how a company is performing in terms of total shareholder returns, including both share price changes and dividends, can be “highly predictive” in terms of determining whether an activist will show up. In addition, companies in consolidating industries without antitrust issues are more likely to be targeted, he added.

Companies that underperform relative to their peers that are insider-controlled, however, have unique advantages. “Ownership definitely matters,” Goodwin said. “One would say, ‘Why would an activist try to get involved if it gets carried to a proxy fight and they can’t win; what was the point of the engagement?’”

Goodwin discussed changing trends for activist campaigns, what he thought about shifts in director tenure expectations and Nasdaq Inc.’s new diversity listing rule proposal. Finally, he also discussed what he thought about upstart activist Engine No. 1’s unusual ESG-focused director contest at Exxon Mobil Corp. (XOM).

“Several years ago, we would have never taken seriously an activist focused around noneconomic issues when compared to activists’ focused on distributing cash via dividends or those forcing a sale of the company,” Goodwin said.

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.