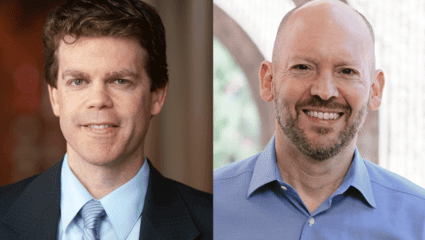

Activist Investing Today: Goodwin’s Sean Donahue on Universal Proxy Cards and More

Changes to proxy contest rules coupled with a “dislocation in equity valuations” and “cash on the sidelines” could be the “perfect storm” for an increase in activist campaigns.

That’s the view of Sean Donahue, a partner in Goodwin Procter LLP’s capital markets and shareholder activism and takeover defense practice.

Donahue spoke with the Activist Investing Today podcast about his expectations for hostile bids as well as a new rule set to take effect Sept. 1 giving institutional investors more flexibility to pick and choose incumbent and dissident candidates on a so-called universal proxy card. He suggested the rule could unleash an explosion of shareholder proposals tied to dissident director candidates nominated by nontraditional and smaller traditional activists.

“Someone nominates themselves and a credible candidate, and they have four or five ESG proposals on the hot topics du jour, whether on climate, giving shareholders the right to call special meetings, or social issues, racial equity audits, whatever it is,” Donahue said. “It puts a lot of pressure on companies to give them a board seat or implement two or three of those proposals or find a mutually agreeable candidate.”

He added that if governance, ESG or smaller traditional activists “decide they want to harass corporate America using universal proxy, I think there is a pretty easy way to do it” if they “can figure out how do it inexpensively.”

Washington-based Donahue also spoke about shifting M&A markets amid a downturn. He said a recent move by BlackRock Inc. (BLK) to give investor clients the authority to vote their own shares may drive more support for activist investors in director contests.

“BlackRock has historically voted with management in director election contests,” he said. “If those votes are being decentralized, on balance [we] don’t know whether those institutions are going to support management, but given that BlackRock in contests has historically done so, I think it will give the activists even more of a potential advantage when it comes to voting at the ballot box.”

Check out the podcast with Sean Donahue below:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.