Corporations reaching settlements with activists often agree to temporarily expand their board size to add directors along with an agreement for some incumbent directors to step off at the next annual meeting.

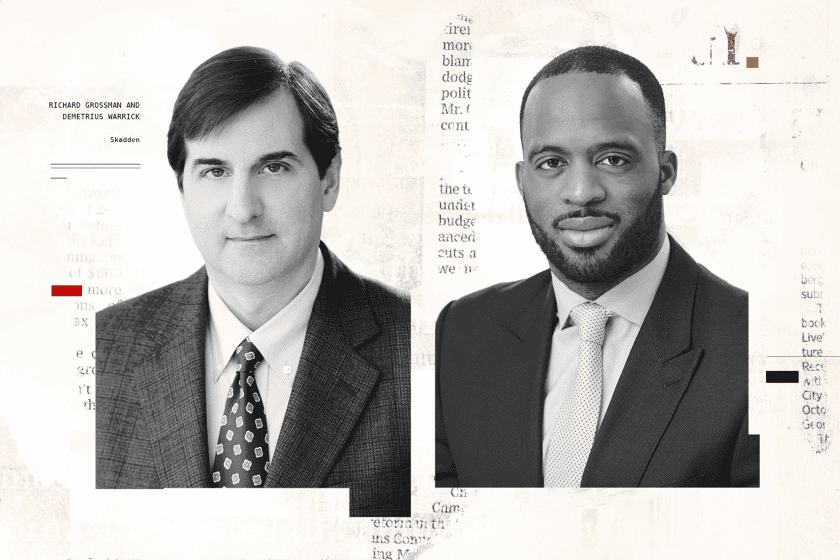

Skadden, Arps, Slate Meagher & Flom LLP partners Richard A. Grossman and Demetrius A. Warrick explained on the latest Activist Investing Today podcast that the structure has may purposes, one of which is to allow outgoing longer-tenured incumbents to assist with the onboarding process for new directors.

“A lot of times the activist doesn’t have a strong view about which incumbent directors should be going off the board, allowing the target to decide for itself,” Grossman said.

He added that the agreement to have incumbent directors step off at the next meeting also avoids “calling out” which incumbents are being removed — if they were to resign, it would trigger an 8-K disclosure.

Grossman and Warrick also offered their two cents on appropriate board size and the types of M&A activism materializing amid a cooling deal market, as well as how corporations should prepare for unexpected short seller attacks. The duo also talked about the growing wave of portfolio managers leaving established activist funds to start up their own firms and how to respond.

Here’s the full podcast with Richard Grossman and Demetrius Warrick:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.