Private equity firms partner with activist funds to conduct hostile bids because insurgent managers understand how to conduct public pressure campaigns and communicate with big institutional investors and proxy advisory firms.

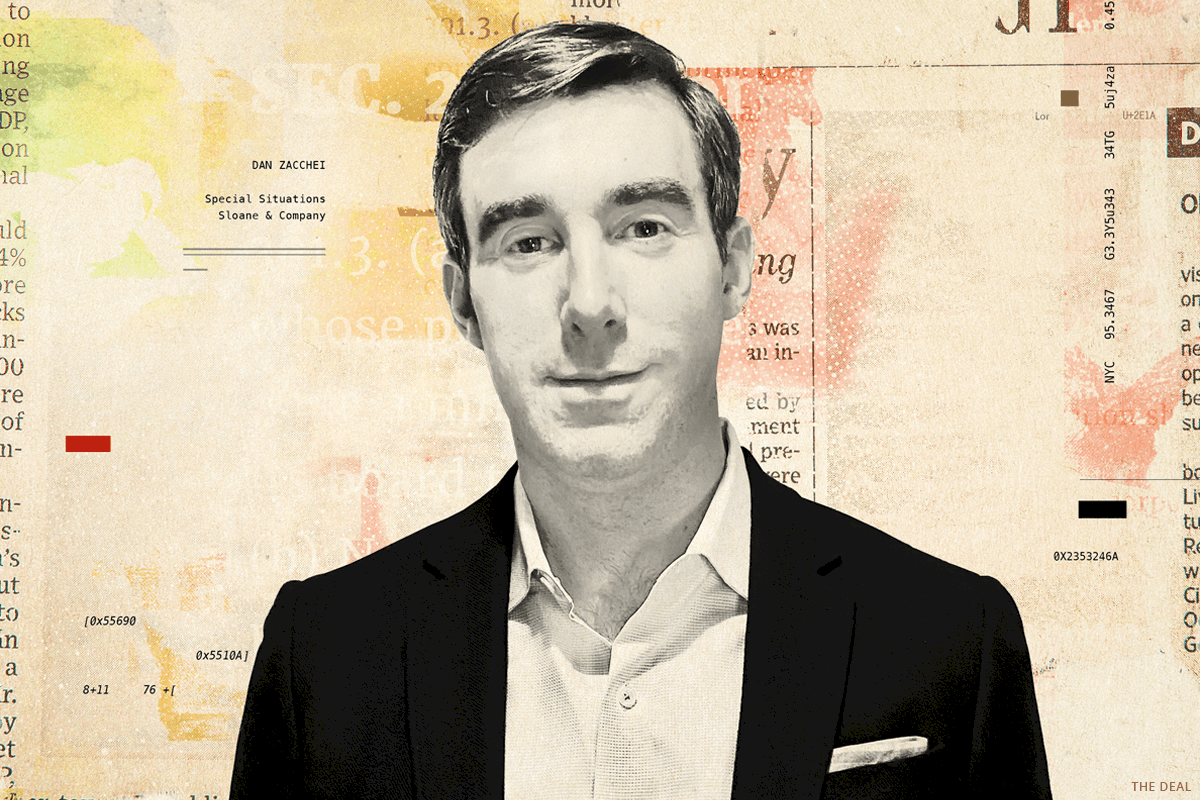

That’s according to Dan Zacchei, president of special situation communications at Sloane & Co., who spoke on the latest episode of the Activist Investing Today podcast.

Zacchei also talked about why he thinks the revival of professional sports amid the pandemic is akin to a new “normalization” for activism and how activism and M&A will fare after the election.

“When the pandemic started in March investors weren’t interested in digging into the details of an activist campaign, and they didn’t have the patience to follow the insurgency blow-by-blow,” Zacchei said. “But now, it’s like where we are with sports. Nobody is in the stands, just like annual meetings and ISS meetings aren’t taking place in person. But sports are back and people are watching and people are tuning in [to activism] and that’s going to lead to some interesting activity.”

Zacchei added that he expects to see more partnerships between PE firms and activists in the months to come. Activist Elliott Management Corp. and buyout shop Veritas Capital Fund Management LLC last month made a hostile bid to buy Cubic Corp. (CUB). Meanwhile, Cannae Holdings Inc. (CNNE) and Senator Investment Group LP are working together on an unsolicited offer to buy CoreLogic Inc. (CLGX).

“If you are a private equity firm, partnering with an activist means you get someone on your side who knows how to wage the public pressure campaign and knows how to navigate the governance groups at big investors, knows how to work through the process of preparing for a meeting with the proxy advisory firms, and if you are the activist, you get a partner who is a relatively assured buyer,” he said. “There are benefits for each side.”

Finally, Zacchei also said he expects “a bit of a wave” of activism and M&A after the 2020 elections conclude next month.

“I have talked to a number of clients who feel they want to hold back on a campaign or transaction on the company side, and I think that makes sense,” he said. “From my perspective, it will be that uncertainty being removed that hopefully will lead to people getting more confident launching campaigns, and when you think about it, it is pretty good timing as the [director] nomination windows are opening up.”

Here’s the podcast:

This and more of The Deal’s podcasts are available on iTunes, Spotify and on TheDeal.com.