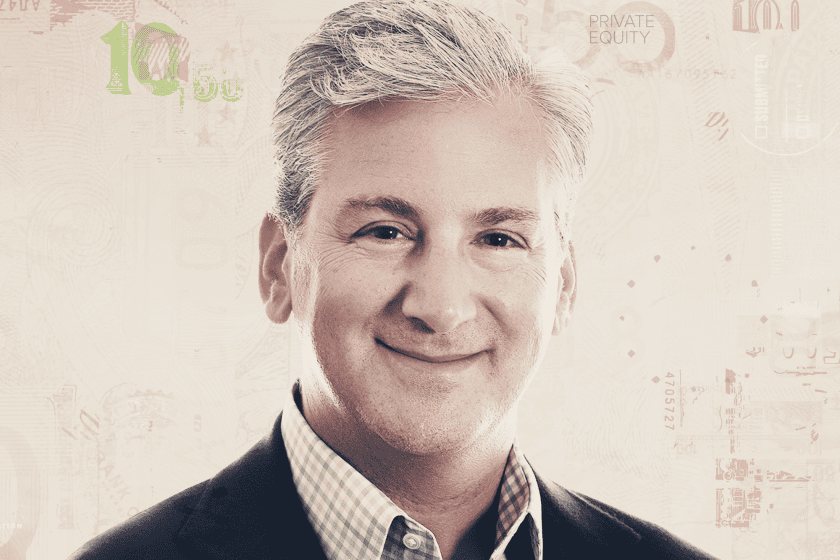

As FTV Capital marks its 25th anniversary, managing partner Brad Bernstein joined The Deal’s Behind the Buyouts podcast to discuss the evolution of payments, enterprise technology, software and financial technology over the past quarter century.

“Financial services is not only the largest vertical market there is, but it’s also the largest market for enterprise technology and services,” Bernstein said. “The interplay between the two is massive and gives us a great lens on how innovation is taking place in enterprise.”

As a result of the interplay, payments, lending and other financial services are increasingly embedded in software tailored toward specific industries.

“More people are disintermediating banks or traditional financial solutions and just integrating into the software,” Bernstein said.

Portfolio company Plate IQ develops accounts payable software for restaurants, hospitality groups and supermarkets. ”We’ve been able to go in and say, ‘Look, you’re doing accounts payable, why don’t you actually offer the payment solution integrated into that accounts payable software?’” he said.

Likewise, FTV Capital’s Sunlight Financial Holdings Inc. operates a platform for solar power installers that manages customer’s applications, underwriting and approvals for financing. “They provide the software to an installer to underwrite a solar loan for a consumer as they’re sitting at the kitchen table talking about a solar system for their roof,” he said.

Other recent middle-market investments range from family office tech to A.I. applications for e-commerce and software to rein in supply chain costs.

Bernstein unpacked other elements of the middle-market firm’s strategy, such as the proprietary software that helps FTV Capital speak to about 11,000 potential portfolio companies a year, and explained how “value-add envy” brought him to the firm two decades ago.

Listen to the podcast with Brad Bernstein below:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.