Behind the Buyouts: Song Serves Up Vestar’s Better-For-You Menu

Welcome to Behind the Buyouts, The Deal’s podcast where we sit down with venture capitalists, private equity pros and company executives to drill down into their capital raising transactions and acquisitions.

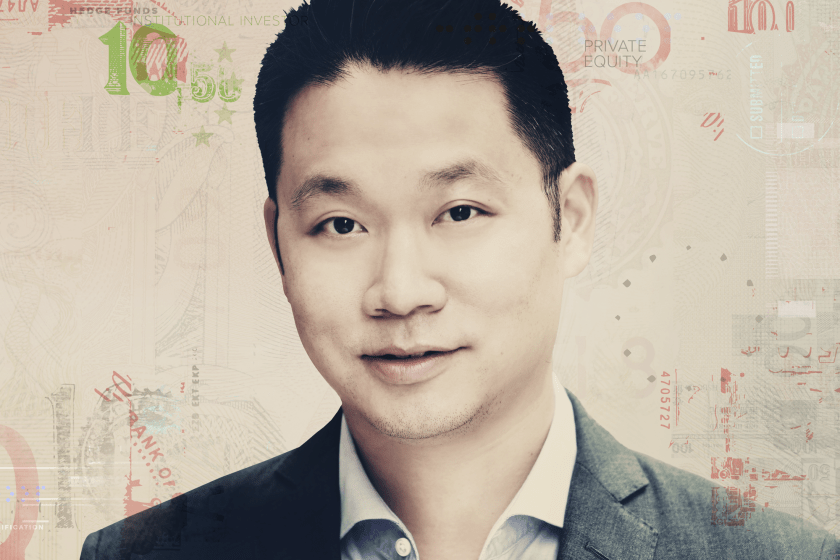

This episode features Winston Song, managing director and co-head of the consumer group at New York-based private equity firm Vestar Capital Partners Inc., who talks about his role in the better-for-you foods business.

When Vestar Capital completed its investment in Dr. Praeger’s Sensible Foods Inc. in January, the maker of vegan, vegetarian, gluten free, soy free, Kosher and non-GMO foods was relatively well-known on the East Coast and West Coast.

Song said he sees potential for a much wider presence for Dr. Praeger’s as the idea of more well-balanced diet grows more mainstream.

“It’s a great brand but relatively low awareness outside the coasts and outside the vegan community,” Song said. “We plan to invest in new products and marketing and bring more consumers. … They’ve got great instincts.”

Song met the management of Dr. Praeger’s at a trade show several years ago and developed a relationship. His interest was also stoked after sampling its products with his young kids.

The firm’s track record reviving Birds Eye Foods Inc. resonated with the company and helped Vestar Capital prevail in a competitive sales process for Dr. Praeger’s.

“Our bread and butter has always been to find these underinvested brands that we think have a lot of potential and have really good leaders that just need more resources,” Song said.

The firm’s experience with natural foods also helped. One early example is its 1989 investment in tea maker Celestial Seasonings Inc., which it sold to Hain Food Group for $390 million in stock in 2000.

Having an authentic product story also really matters to consumers. In the case of Simple Mills Inc., a Vestar portfolio company since 2019, Simple Mills founder Katlin Smith launched the company after she decided to improve her diet by renting out a commercial kitchen and creating her own baked mixes.

Vestar Capital continues to work to identify sustainable food trends instead of short-lived food fads, with the firm looking at low-sugar foods as a common thread for consumers interested in cutting out carbohydrates and sugar.

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.