Hello and welcome to Behind the Buyouts, The Deal’s podcast where we sit down with private equity and venture capital practitioners and talk about their deals and dealmaking.

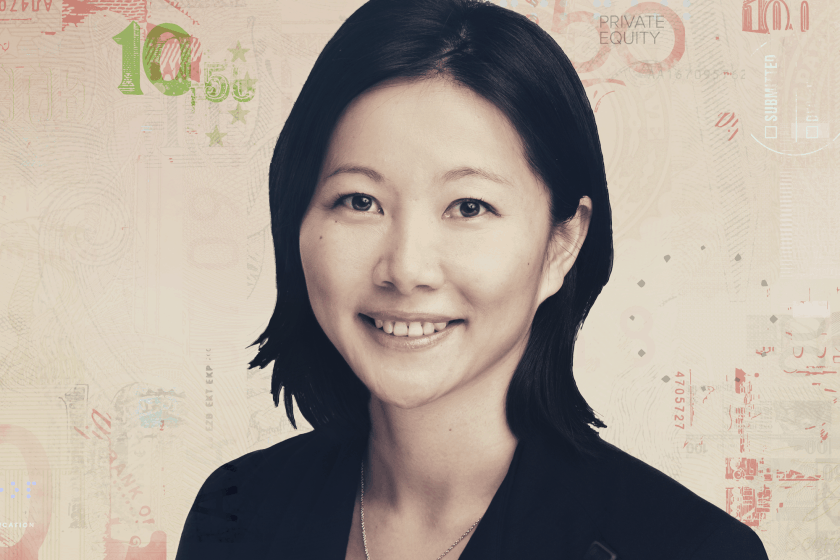

Rene Stewart is senior managing director of the Vista Endeavor Fund, a $1 billion vehicle that targets tech companies with revenue of $10 million to $30 million. It’s part of technology-focused private equity firm Vista Equity Partners LLC. In the world of PE, Endeavor ranks as a small-cap fund focused on a rapidly growing subsector.

Stewart said the firm is dealing with current high prices in the M&A arena by finding top-tier business-to-business software companies and using operating support instead of financial engineering to boost growth.

“Our approach in navigating these pretty frothy times is to continue to focus on the highest-quality businesses,” Stewart said. “We would much rather slightly overpay for a very high-quality business than to overpay for a lower-quality business or even go bargain hunting.”

Stewart said even if market conditions change and valuations fall, multiples tend to hold their ground with higher-quality companies.

Endeavor fits into the overall mix at Vista Equity as a growth equity and buyouts business line that typically acquires 20% to 70% of software companies. Overall, Vista Equity ranks as the largest enterprise software investor in the world, with $75 billion in assets under management, and has been in business for more than two decades.

Some recent deals by Vista Endeavor include Schoox Inc. and It’s Never Too Late LLC.

Stewart talked about avoiding risk in investing in younger companies in the competitive software M&A market. She also shared thoughts on working effectively with entrepreneurs and the rewards of doing so.

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.