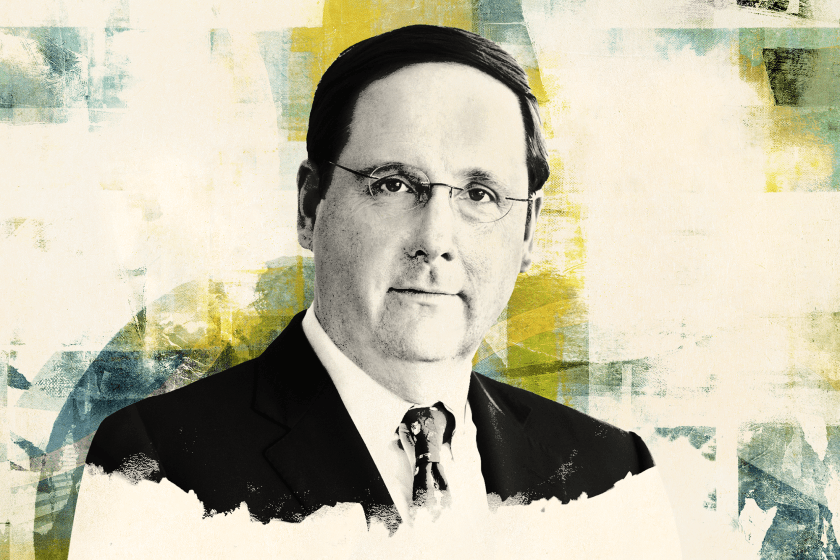

“The SPAC market has almost become a late-stage venture capital market,” R. Alec Dawson said on this week’s Drinks With The Deal podcast. Even a few years ago, said Dawson, an M&A partner at Morgan, Lewis & Bockius LLP in New York, shareholders in the operating companies that combined with special purpose acquisition companies would generally sell a good chunk of their stock in such transactions. Now, those shareholders — whether founders of technology companies or private equity funds — are much more likely to take equity in the entity created by so-called de-SPAC transactions.

Dawson also discussed the challenges the SPAC market faces. SEC pronouncements on the vehicles’ use of warrant accounting and earnings projections “tied up every accounting firm and every big law firm that tried to deal with the problems that raised,” he said, at a time when hundreds of SPACs are seeking merger partners.

Delaware plaintiffs’ lawyers have also focused on perceived problems raised by de-SPAC deals. In response, SPAC boards are starting to get fairness opinions, and their independent directors are retaining separate counsel more frequently. Serial sponsors have started to vary the composition of the boards of their SPACs to make it harder for plaintiffs’ lawyers to challenge director independence, Dawson said.

He predicted that a new set of serial sponsors who come up with different ways to do SPACs may emerge but believes that the structure will persist.

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.