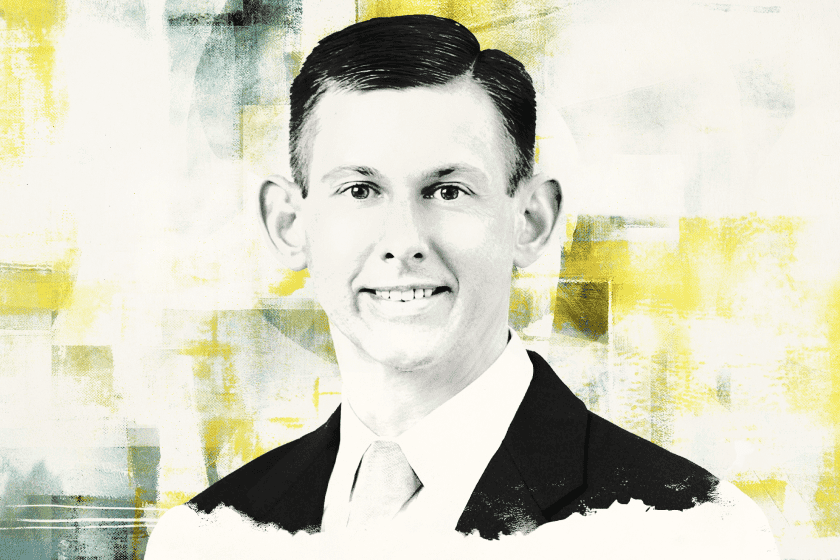

“You can’t just be a good lawyer in this business. You’ve got to be an energy professional,” Austin Lee, an energy M&A partner at Bracewell LLP, said on this week’s Drinks With The Deal podcast.

After graduating from the University of Texas with a degree in accounting, Lee spent a year working in that field before becoming a landman, a role unique to the oil and gas industry. Landmen do title research on oil and gas properties and often negotiate leases and other operational and sometimes transaction agreements, Lee said.

“It’s a transactionally focused job that was good preparation for being a corporate lawyer,” he said. After graduating from the University of Texas School of Law in 2009 he started at Bracewell at a time when the shale boom was spurring growth in the energy industry. Private equity sponsors, he said, were “sponsoring teams of people who often were my age,” which offered significant opportunities for a young lawyer.

Lee spent a year as an in-house lawyer at Newfield Exploration Co., but he returned to Bracewell because, he said: “I had a ton of contacts in the business who could be potential clients. That offered a better career path for me and an accelerated career path.”

Like many people in Houston, Lee has an eye on energy transition. “Anybody entering into the energy business should be excited about a lot of these new transition technologies and the opportunities they offer, but they also need to have a realistic expectation about how fast that’s going to occur,” he said. “It’s going to take decades.”

Listen to the podcast with Austin Lee below:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.