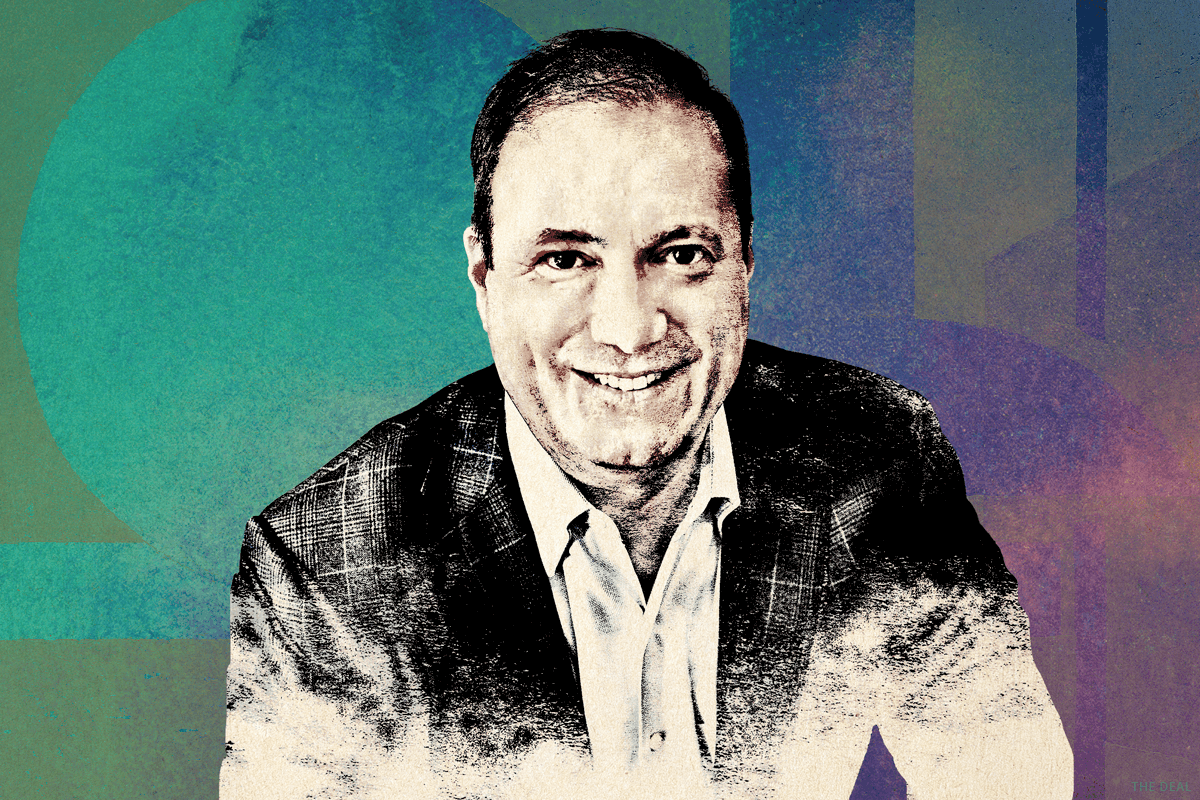

“Run to experience even though you may fail,” Chris Varelas tells The Deal’s David Marcus in this edition of the Drinks With The Deal podcast, in which Varelas discusses his new book “How Money Became Dangerous,” co-written with Dan Stone, and the unlikely path he took to run technology, media and telecommunications investment banking at Citigroup Inc. (C).

After a stint as a lending officer at Bank of America Corp. (BAC) covering the diamond district in Los Angeles — a world that reminded him of Pulp Fiction, Varelas says — he became an investment banker at Salomon Brothers. He left New York for Silicon Valley after the dot-com bust. “Before then,” Varelas says, tech clients went to “Goldman, Morgan Stanley or wherever Frank Quattrone was. You can only form real strong relationships during times of difficulty. You build market share when times are bad, and you reap it when times are good.”

Varelas loved the big personalities he met as a banker. “One thing that’s great about a career on Wall Street is that you get to meet these forces of nature,” he says. “They’re special people who are imposing their will on the world.”

In 2008, Varelas left Citi to launch Riverwood Capital, a Menlo Park, Calif.-based private equity firm focused on technology. In doing that work, he’s met a different outsized personality — the influencer, a reflection of a generation whose mentality is “I am what I share,” Varelas says. “That’s not me, but I like being thrown into worlds I know nothing about.”

More podcasts from The Deal are available on iTunes, Spotify, and on TheDeal.com.