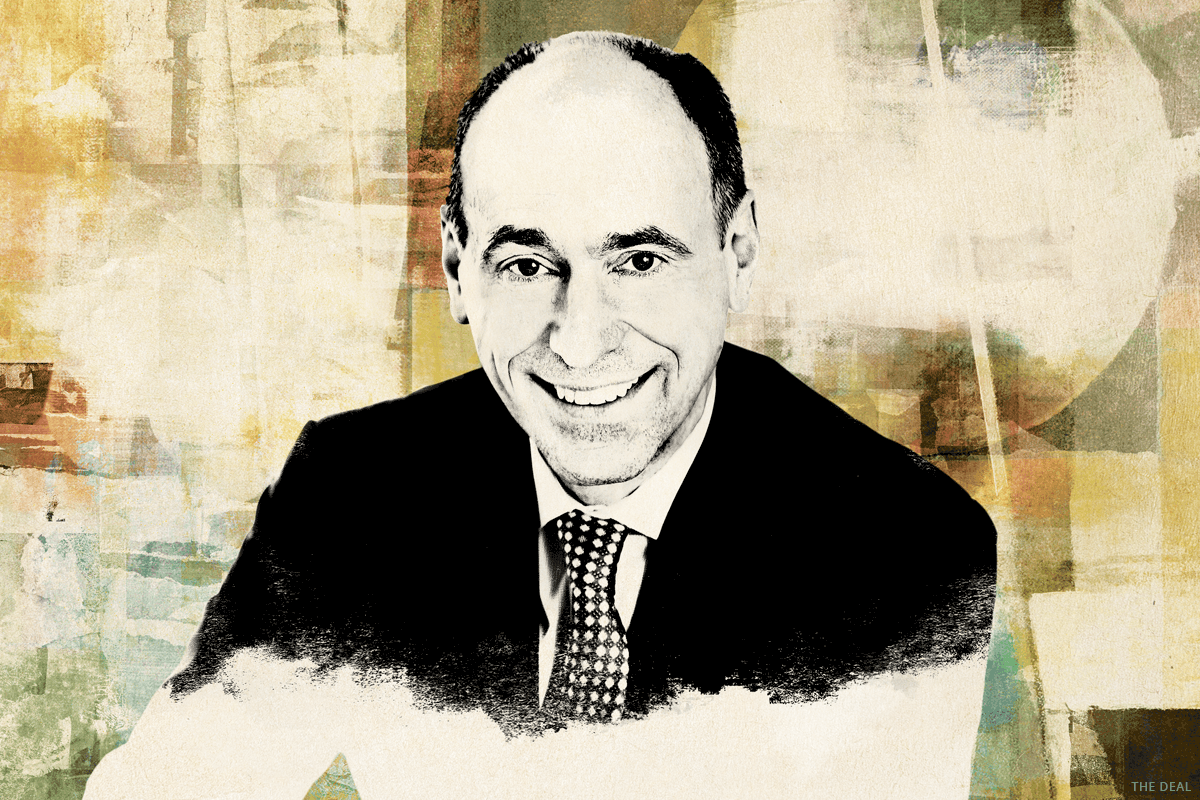

Doing deals for Clayton, Dubilier & Rice LLC has been a constant in Paul Bird’s career, the Debevoise & Plimpton LLP partner said on this week’s Drinks With The Deal podcast.

As an associate, he helped advise the New York private equity sponsor on its purchase of IBM Corp.’s (IBM) printer, typewriter and keyboard business for $1.5 billion in 1991 to create Lexmark, Big Blue’s first major divestiture and a signature deal for CD&R. This summer, he represented CD&R on its simultaneous purchases of the White Cap construction and industrial business from HD Supply Holdings Inc. (HDS) for $2.9 billion and of Construction Supply Group, a distributor of specialty concrete and masonry accessories owned by Sterling Group LP.

The Lexmark deal, Bird said, was a transaction that required sales of related divisions around the world. The White Cap transaction had its own complexities, since Debevoise had to run parallel teams on the White Cap and CSG deals and coordinate the financing for both deals.

Bird also represents a number of corporate clients, including Schneider Electric SE. He advised the French energy management and automation company on one of its early major software deals, the $2 billion takeover of Spanish industrial software business Telvent GIT SA in 2011. In August, he counseled Aveva plc, in which Schneider holds a 60% stake, on its $5 billion acquisition of OsiSoft LLC.

When not signing up deals during the pandemic, Bird has relaxed by running, fishing and watching the Frick Museum’s “Cocktails With a Curator” series. He particularly enjoyed Xavier Salomon’s discussions of Holbein’s portrait of Thomas More and Bertoldo di Giovanni’s medal depicting an attempted coup against the Medicis in Florence.

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.