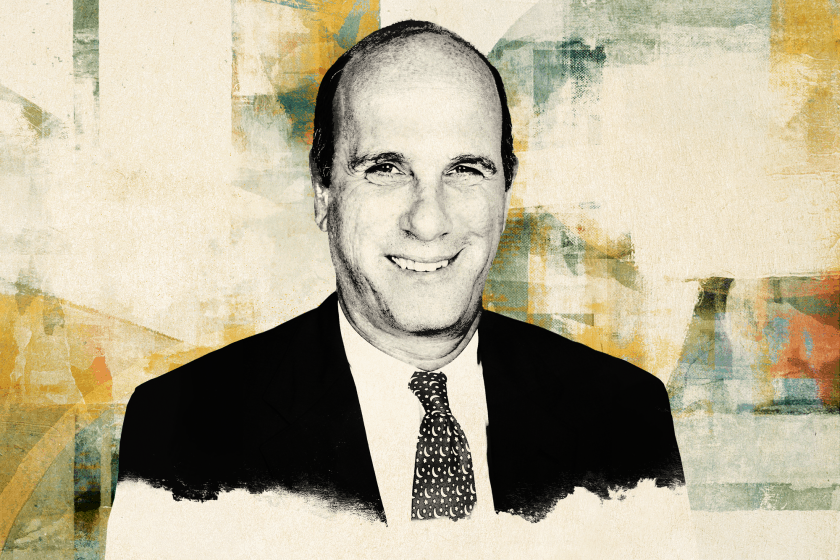

Stuart Cable and his colleagues at Goodwin Procter LLP in Boston saw the biotechnology sector emerging across the Charles River in Cambridge, Mass., about 15 years ago, and they set out to build a law firm that could serve it. That required developing a team of highly specialized lawyers who could work on issues faced by biotech companies ranging in size from startups to multibillion-dollar public companies, Cable says in this week’s Drinks With The Deal podcast.

One of those entities is Moderna Inc. (MRNA), which Cable began advising when it was launched a decade ago. He and Goodwin’s Kingsley Taft and Gregg Katz were issuer counsel on the Cambridge company’s 2018 IPO, and Cable calls his work in helping Moderna build out legal, public affairs and commercial teams as the company developed a Covid-19 vaccine in 2020 “the most challenging and rewarding experience of my career.”

Cable, Goodwin’s vice chairman and global chair of M&A, also discusses his work in advising MyoKardia Inc. on its $13.1 billion sale to New York-based Bristol-Myers Squibb Co. (BMY) last year and Spark Therapeutics Inc. on its $4.8 billion sale to Roche Holding AG in 2019, deals that required the sellers to use different tactics to get the best price.

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.