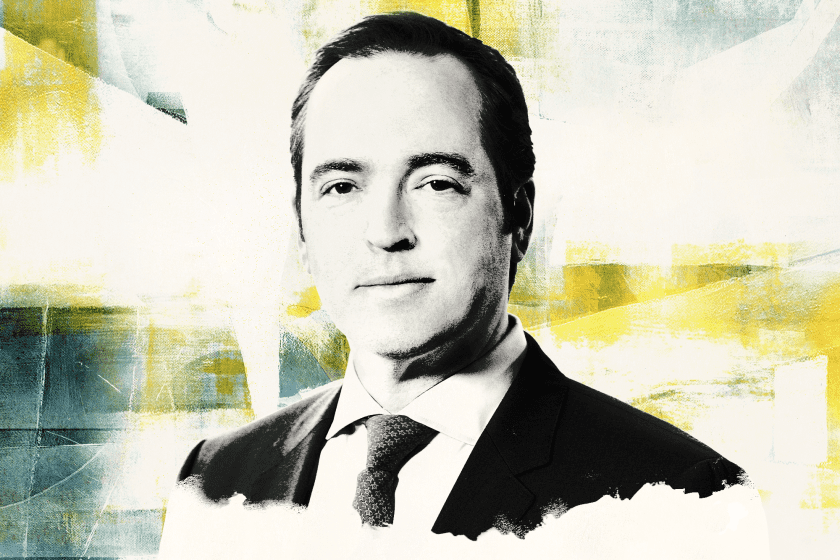

“The socialization has always been the beauty of this job,” said Andrew Levine, global co-chair of private equity at Jones Day in New York, on this week’s Drinks With The Deal podcast. “What really makes the job enjoyable is being part of a team and working with people you like to work with and seeing younger people develop.”

Levine said that aspect of practicing law makes it critical for firms to have lawyers in the office. “It’s 100% about the people,” he said. “If you took the social aspect away from the business permanently, you would lose what keeps people interested.”

Levine has spent his entire career at Jones Day, which he joined out of law school in 1998, and does work for both private equity sponsors and strategics, a variety he enjoys.

He said that the M&A market has seen “a strong year by any other measure” than 2021.

Levine said the market had anticipated a bit of a lull in 2022 but that private equity, especially as it relates to the middle market has remained strong and should continue to hold up despite financing markets that have put a damper on some large cap dealmaking.

“The high end has slowed down because of the financing challenges, but the mid-market PE is still going strong,” he said. “The financing terms haven’t gotten that much worse, the prices are holding pretty firm. It’s been a pretty good year.”

Here’s the podcast with Andrew Levine:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.