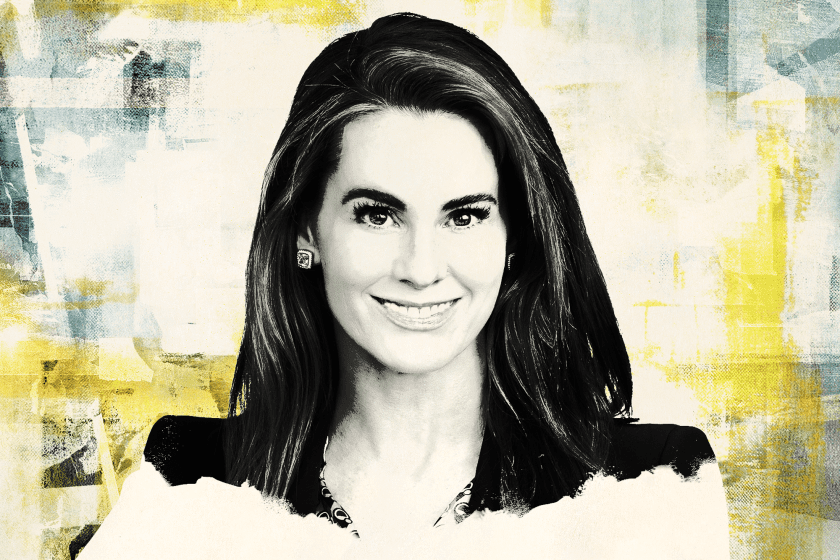

The M&A boom that began in June 2020 has put significant pressure on middle-market dealmakers, Kimberly Smith, the global chair of the corporate department at Katten Muchin Rosenman LLP in Chicago, said on this week’s episode of Drinks With The Deal.

Smith does much of her work in the middle market, where private equity sponsors have had to adjust their strategies by making minority investments, doing complicated carve-out transactions or signing up two or three smaller deals simultaneously to get to a desired investment size.

In addition to working with PE sponsors, Smith advises family offices, including Equity Group Investments LLC, Sam Zell’s investment vehicle, and Penny Pritzker-run PSP Partners LLC, which Smith advised on its recent purchase of Ntiva Inc. And she worked across from MSD Partners LP last year, advising West Monroe Partners LLC on selling a 50% stake to Michael S. Dell’s investment vehicle. Family offices may not have the same near-term pressure to generate returns as PE sponsors, Smith said, but they must nevertheless compete with sponsors in auctions and figure out ways to incentivize target management teams.

Smith said that even in the middle market, scrutiny by antitrust and foreign investment regulators has increased in both the U.S. and Europe. Parties to deals will have to respond by focusing on the interim covenants as regulatory scrutiny increases the time between signing and closing and by proactively managing regulatory risk, she said.

Here’s the podcast with Kimberly Smith:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.