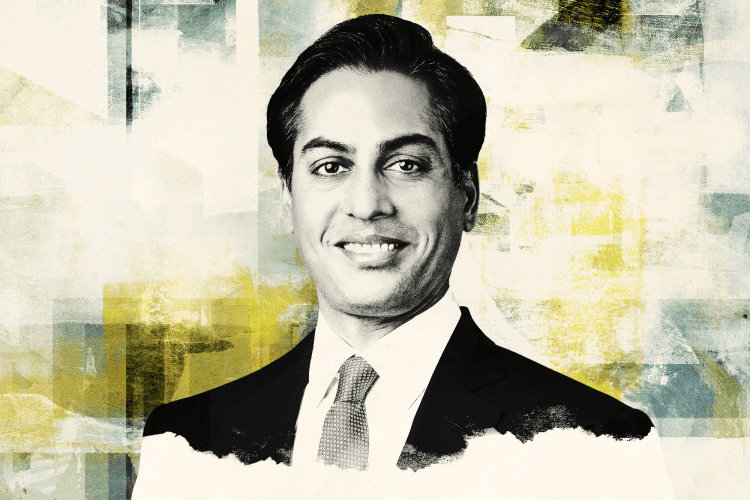

Sanofi SA’s (SNY) $3.2 billion acquisition of Translate Bio Inc. was a classic healthcare deal, said Krishna Veeraraghavan, a partner at Paul, Weiss, Rifkind, Wharton & Garrison LLP who advised the target on the deal.

Translate has cutting edge mRNA vaccine technology, while Sanofi “has a huge vaccine machine, in particular for the flu,” Veeraraghavan said. “This is a transaction where you have Translate Bio giving its technology, which is excellent, to a bigger company which has the ability to take it to the next level.”

Years ago, he said, “Big pharma made a decision that they were not effective at doing R&D. That has been outsourced to biotech companies,” an arrangement that has worked well for investors, companies and consumers. Increased skepticism of M&A in Washington and a greater willingness on the part of regulators to challenge deals risks discouraging innovation in the pharma and biotech sector, said Veereraghavan, who does a lot of work in the space.

“These deals are critical to bringing the smaller company’s product to the public,” he said. “Moderna was able to do it themselves, but they are the exception. To bar these transactions discourages innovation on the biotech side.” Historically, he said, regulators have realized that M&A is essential for the commercialization of useful drugs. “The deals that have happened have been helpful for patients.”

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.