“All of us who’ve been doing M&A for a while have had various bits of this in different situations, but not at this scale and not all together,” Steven L. Camahort said of Elon Musk’s fraught effort to acquire Twitter Inc. (TWTR) on this week’s Drinks With The Deal podcast. Camahort, the chair of global M&A at Paul Hastings LLP, isn’t involved in the matter, but, he said, “It’s very high profile, and the main lawyers working on it are people I know very well, so it does make for an entertaining situation from afar.”

Musk agreed to pay $44 billion for Twitter in a merger agreement that’s modeled on the contracts that private equity sponsors use to acquire public companies, Camahort said. If financing for the deal is available to the buyer, then the buyer must complete the deal, but if not, the buyer may walk with the payment of a reverse termination fee — $1 billion, in Musk’s case.

“For financial sponsors, the reverse termination fee is the maximum cash exposure for willful or inadvertent breach,” Camahort said. “For a corporate buyer using debt financing, it’s more common for that cap not to be there. It’s a significant win for Musk in his contract that he’s on a sponsor-type model.”

As occurred in a number of deals signed in the early months of the Covid-19 pandemic in 2020, Musk has suggested he has the right not to close the Twitter acquisition because of issues at the target. As Camahort noted, material adverse effect clauses and interim operating covenants have frequently been subjects of dispute in troubled deals over the past few years, and they are at issue again in the Twitter saga.

But Musk’s mercurial personality may be more important than the legalities of the situation, Camahort said. “Even if you were to negotiate a revised agreement, it’s not clear how much stock he puts in complying with his agreements. That might be something that drives more of a binary outcome, where Twitter says this is not a normal situation, we’re not going to get any added certainty if we reduce this price, so let’s just fight it out now at the highest price. That would be my guess, but who knows.”

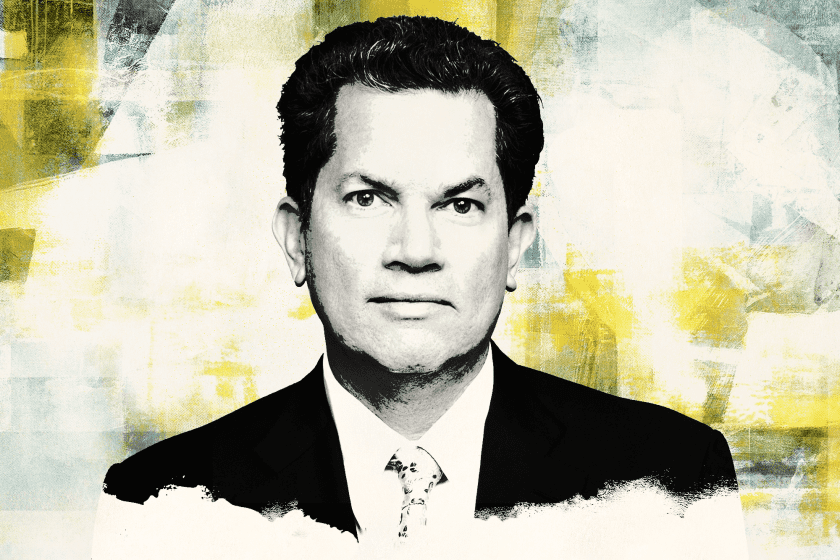

Here’s the podcast with Steve Camahort:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.