Last fall’s sale of Tiffany’s Inc. (TIF) was perhaps the most-widely covered M&A transaction of 2019, as media of all sorts covered LVMH Moet Hennessy Louis Vuitton SE’s hostile bid for the jewelry retailer and its ultimately success deal to sell to the luxury goods company for $16.2 billion.

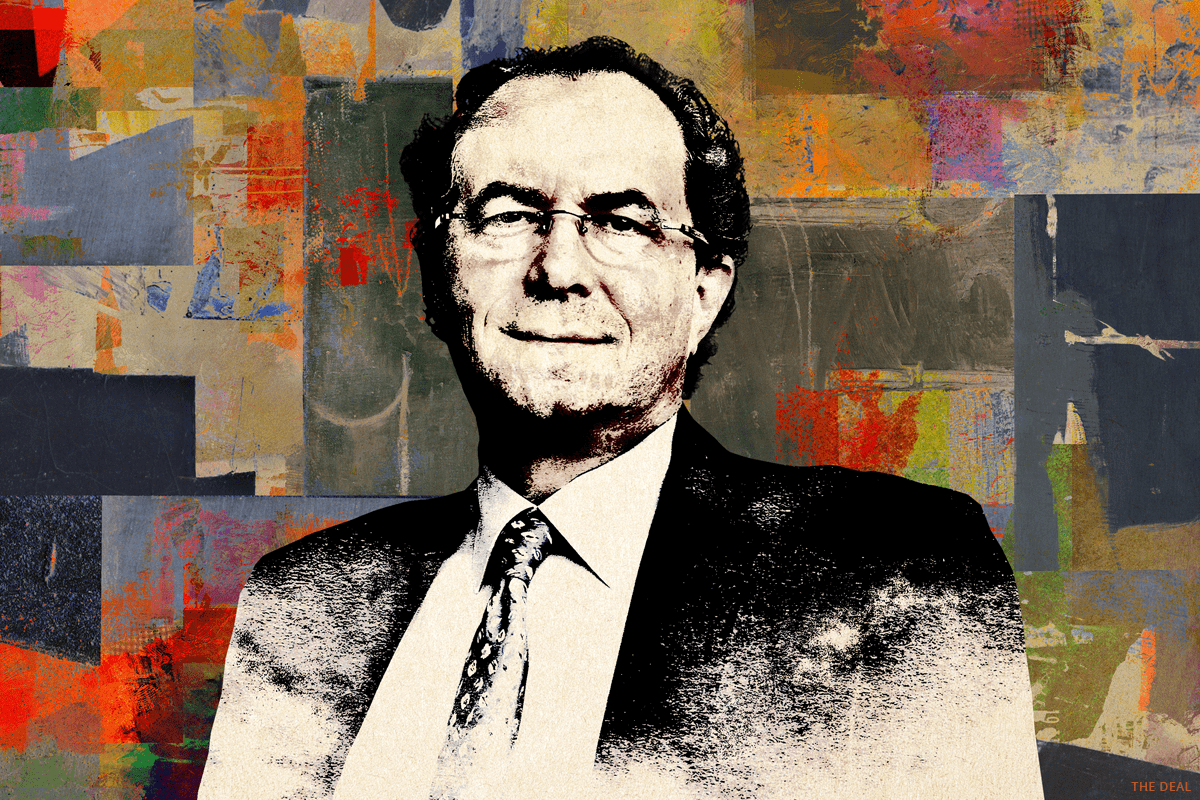

But Frank Aquila, the Sullivan & Cromwell LLP partner who advised the target, told its directors to ignore the coverage and focus on achieving the best result for the company, as he discusses with The Deal’s David Marcus on the latest Drinks With The Deal podcast.

Aquila also talks about his work on two other large pharma deals last year. Sullivan’s head of M&A advised longtime client AmGen Inc. (AMGN) on its purchase of Otezla, a treatment for psoriasis and psoriatic arthritis, for $13.4 billion from Celgene Corp. (CELG) as part of its sale to Bristol-Myers-Squibb Co. (BMY) and Novartis AG on its $9.7 billion purchase of Medicines Co.

Aquila has done work for many years for Diageo plc and Anheuser-Busch InBev SA/NV (BUD), which he represented last fall on its $221 million purchase of Craft Brew Alliance Inc., and discusses the changing market that consumer goods companies face.

A food and wine aficionado in his spare time, Aquila enjoys searching out distinctive spots around the globe, from Angel’s Share, Brandy Library and Don Angie in Manhattan to The Old Man in Hong Kong and Bar Orchard in Tokyo.

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.