The top proponent of shareholder proposals spoke with The Deal for its Activist Investing Today podcast about what he thinks would happen if the Securities and Exchange Commission made it more difficult to submit proposals on environmental, social and governance issues.

If investors were required to own 1% of a company’s shares to submit a nonbinding shareholder proposal, it would essentially eliminate the mechanism as it is known today.

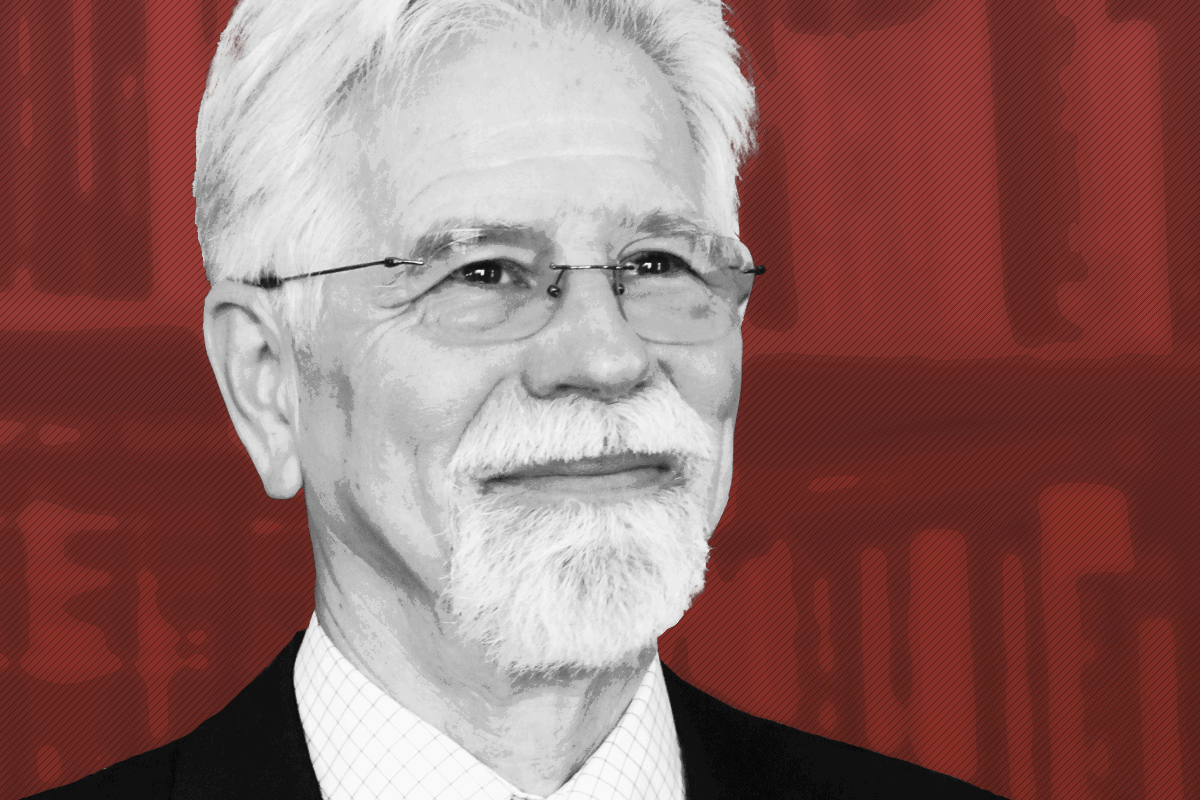

That’s the view of James McRitchie, who has submitted hundreds of shareholder proposals at U.S. corporations over the past couple of decades. The publisher of CorpGov.Net talked about corporate shareholder proposals, resubmission thresholds and a controversial new statement of purpose issued by the Business Roundtable. In a wide-ranging conversation, McRitchie discussed what he thinks would happen to the shareholder proposal mechanism if the nation’s securities regulator issued new rules making it more expensive and increasingly difficult for investors to use.

“If it was anywhere near 1% to file, it would eliminate the whole thing because most proposals come from retail shareholders and the other large ones are from a few large pension funds,” McRitchie said.

On the podcast, McRitchie listed off the various groups that traditionally submit proposals, noting that even the largest employer of the investor mechanism, the California Public Employees’ Retirement System, typically holds only one-fifth of 1% of a company.

McRitchie also criticized any regulatory effort that would make it difficult to resubmit shareholder proposals in subsequent years if they received a particularly low level of support. “As far as resubmission — a lot of things take time,” McRitchie said. “I’ve been filing proposals on transparency in political contributions. They have been getting low votes, in the single digits. But last year I finally won one. Social issues and corporate governance issues, a lot of that takes time.”

More podcasts from The Deal are available on iTunes, Spotify, and on TheDeal.com.