A lawsuit or two challenging California’s recently approved board diversity law is likely to emerge, though the proponents of such a challenge may not be immediately apparent.

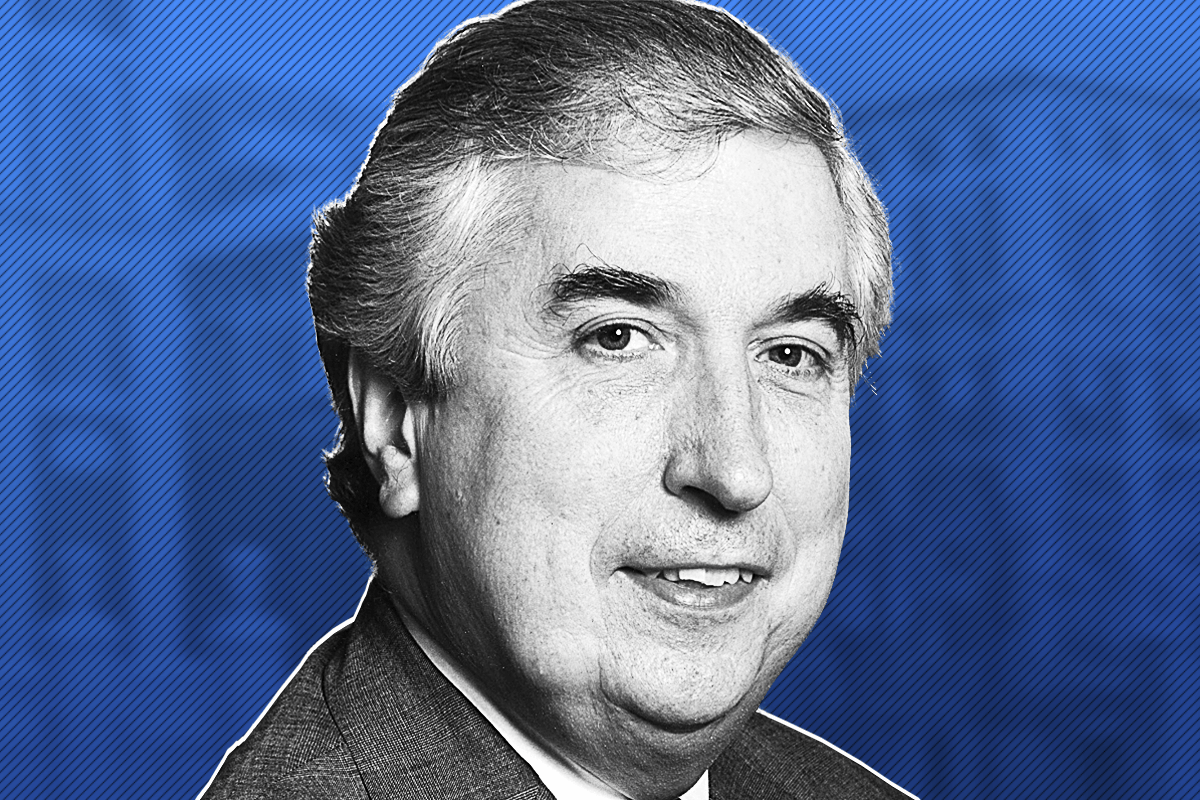

At least that’s the view of Columbia Law School Professor John Coffee, who spoke with The Deal for its Activist Investing Today podcast about a new trend of legislators pushing to require corporations headquartered in their states to set up diverse boards. In California, a recently approved law requires one female to be installed on each locally-headquartered, publicly-traded corporate board by the end of this year. Coffee suggested that corporations based in the state without women directors may decide against filing a lawsuit challenging the restriction because of what he calls a “high embarrassment” cost.

However, he also suggested that “ideological organizations” on the right, such as the CATO Institute, may bring derivative actions, buying a small number of shares, and suing in the name of the company to contest the California law.

“It would require some degree of collusion between the company and investor, but it is possible we would see that as well,” Coffee said. “There is a quite uncertain future facing this legislation.”

Here’s the podcast:

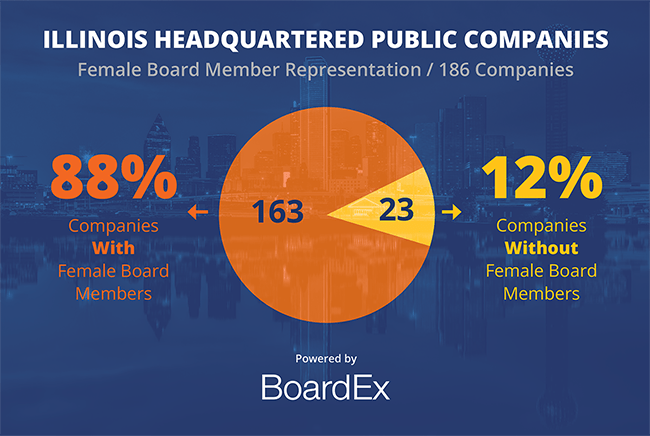

Here’s some data about Illinois headquartered public companies and women directors:

More podcasts from The Deal are available on iTunes, Spotify, and on TheDeal.com.