As the pandemic shut down fitness club operations and slowed dealmaking, Roanoke, Va.-based Asbell Group, a 13-location Planet Fitness Inc. (PLNT) franchisee, was forced to hit the brakes on its sale plans in March 2020.

Other franchisees like Asbell, including private equity-backed companies that were due to exit around the time, had to similarly pause or delay plans as people were confined to their homes, connected fitness boomed and doubts were cast over the future of in-person workouts.

But as the recovery made by Planet Fitness and its competitors in recent months shows, demand for gyms remains, as does investor appetite, prompting fitness club franchisees to once again gear up for M&A.

A year after its dealmaking plans were derailed, Asbell decided to test the market again in summer 2021 and saw inbound interest from both private equity firms that have never invested in the Planet Fitness system before as well as other Planet Fitness franchisees looking to expand their footprint, said Fidus Partners LLC managing director Christopher Haza, who ran the process for Asbell.

It eventually sold to HGGC LLC- and Monogram Capital Partners LLC -backed Grand Fitness Partners, a then 44-location Planet Fitness franchisee, for an undisclosed amount in December. Grand Fitness Partners itself had nabbed a majority investment from HGGC a month before — four years after Monogram, which is staying on as a minority investor, first invested in the company.

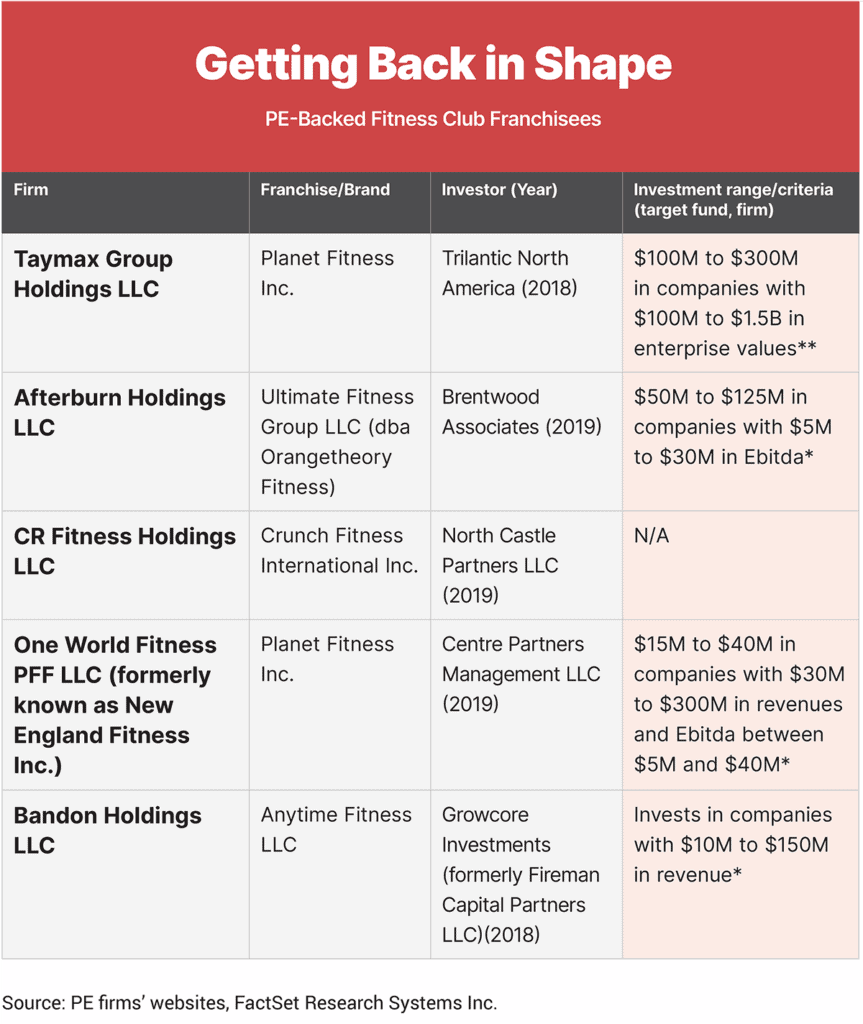

In particular, industry dealmakers anticipate M&A for private equity portfolio franchisees edging closer to the end of the typical five-year hold periods to pick up pace in the next six to 12 months as businesses look for capital to expand operations and financial sponsors feel the pressure to stick to exit timelines.

Editor’s note: The original version of this article was published earlier on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.

This Content is Only for The Deal Subscribers

If you’re already a subscriber, log in to view this article here.