The buzz that Microsoft Corp. (MSFT) is in talks to back artificial intelligence company OpenAI LP at a $29 billion valuation shows the exuberance surrounding AI — even in a dismal market for deals.

The viral spread of artificial intelligence to chatbots, vaccine research, legal work, self-driving cars, energy exploration and other industries seems boundless. Yet the growth raises a question — is the current infrastructure up to it?

“We’re about to deploy AI over a huge swath of the software platforms on the planet,” Houlihan Lokey Inc. managing director Brian Pryor said. “AI, machine learning and high-density deployments like weather modeling and oil and gas prospecting often can’t be handled by traditional data centers.”

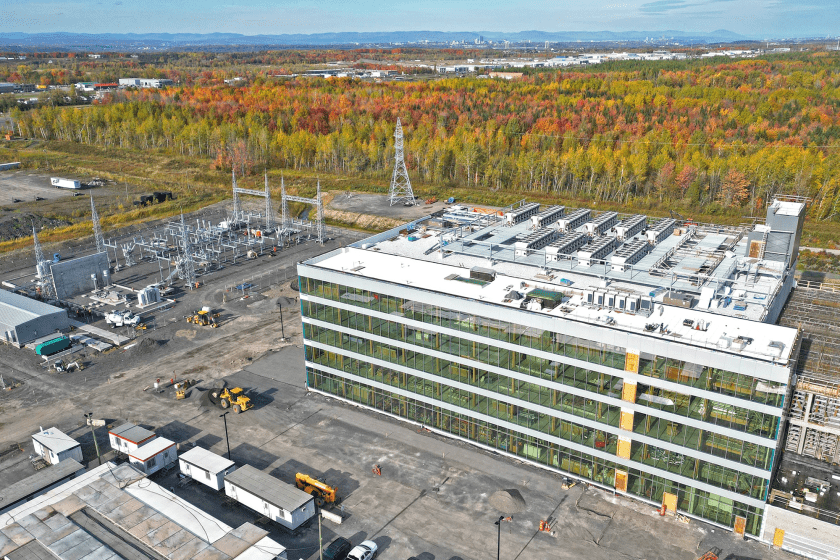

New high-performance computing data centers that support such massive workloads are expected to be the fastest-growing subsector in the data center colocation market over the next five to 10 years, Pryor added.

The high-performance facilities have specialized requirements for power, location, cooling systems and design so that super computers can crunch AI workloads. This may create some sticking points for name-brand tech companies such as Apple Inc. (AAPL), Amazon.com Inc. (AMZN) and Microsoft — and the Securities and Exchange Commission — which are increasingly concerned about the climate.

Early entrants in the nascent industry have attempted to address some of those issues. And for sponsors and infrastructure funds that have eagerly invested in telecom infrastructure, HPC data centers may nevertheless present a new niche to explore.

Editor’s note: The original, full version of this article on high-performance data centers was published Jan. 13, 2023, on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.

This Content is Only for The Deal Subscribers

If you’re already a subscriber, log in to view this article here.