In August, activist Jana Partners LLC disclosed it had accumulated a 324,930-share position in government and defense services company Leidos Holdings Inc. (LDOS).

And though the Barry Rosenstein-led activist fund hasn’t spoken publicly about the 0.24% second-quarter allocation, it’s possible that Jana, or other investors, could launch a campaign urging Leidos to divest assets or take other actions to improve the company’s share price.

Jana, too, has launched M&A-focused campaigns at similar defense-and government technology and IT service companies in recent years.

“There are folks who look at the security unit as not measuring up and they believe it could be considered for divestiture,” said Robert Spingarn, analyst at Melius Research LLC.

Leidos, a Reston, Va.-based defense, government IT services and security conglomerate, in February 2020 acquired L3Harris Technologies Inc.’s (LHX) Security Detection and Automation business, which makes TSA body scanners and checked baggage scanners at airports, for about $1 billion. The deal was one of many bets that have underperformed since acquisition.

“When air traffic collapsed amid Covid, demand for upgraded scanners and replacement parts collapsed as well,” Springarn said. “The business is recovering but supply chain issues have kept it from a full recovery.”

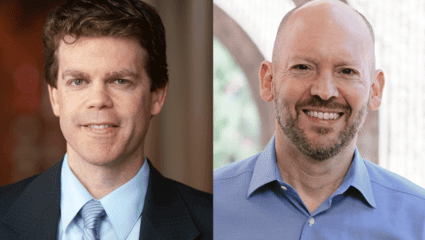

In May, meanwhile, Leidos shares dropped precipitously following a poor first-quarter earnings report that missed expectations. Also, in May, Thomas Bell, the former CEO of Rolls-Royce North America Inc., joined the company as CEO after Leidos surprised the market in February by announcing that longtime chief Roger Krone would resign.

One defense industry M&A banker raised questions about Krone’s exit and whether it was fully consensual. Leidos’ board may be concerned about profit margins for the company’s core business, and with its recent acquisitions, he said.

Jana, which didn’t respond to a request for comment, may be looking to Bell and Leidos to “reconfigure the portfolio” by spinning off or selling some assets, the banker added.

The activist fund, which may have accumulated its stake in May after the share price drop, or other investors might be privately pushing to spin off or sell a unit at Leidos already.

Divestitures seem to be an increasing possibility as acquisitions appear off the table for now. Bell indicated on an Aug. 1 earnings call that he isn’t focused on buying companies. “We’re really focused on executing the work we have on our plate now before we get back in the market to do M&A,” Bell said.

Leidos didn’t return a request for comment.

Editor’s note: The original, full version of this article was published Sept. 15, 2023, on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.

This Content is Only for The Deal Subscribers

If you’re already a subscriber, log in to view this article here.