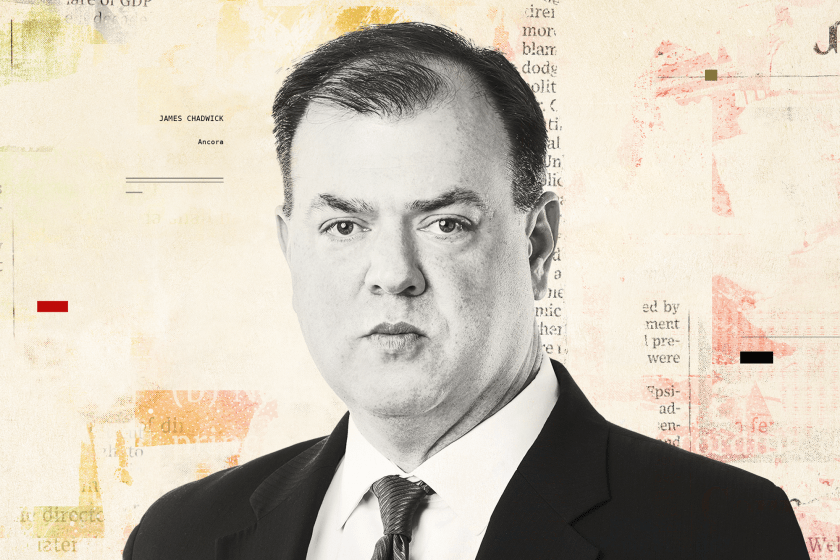

Struggling retailers should consider selling and leasing back real estate to boost their valuations, according to Jim Chadwick, head of alternative investments and portfolio manager at Ancora Advisors LLC.

Big-box retailers own real estate that is effectively not getting any value from the markets — and in some cases the market isn’t even aware of due to limited disclosure requirements, Chadwick said during the latest episode of The Deal’s Activist Investing Today podcast.

“What is new is that over the past several years as retail has fallen out of favor and a lot of retailers are trading at very low multiples, when you see that and have an asset [real estate] that is getting no value from the market and often times unknown by the market because of [very limited] disclosure requirements,” Chadwick said.

Chadwick talked about the fund’s sale-leaseback thesis for Kohl’s Corp. (KSS), a department store chain that Ancora and three other funds targeted last month with a change-of-control director contest. Chadwick suggested that proceeds from sale-leasebacks could be used to de-leverage and to buy back stock.

“In the case of Kohl’s, as with Big Lots, the real estate value was a significant portion of the market cap today,” Chadwick said. “We think at Kohl’s there is $7 billion of real estate value that could be monetized.”

Chadwick also discussed the fund’s allocation strategy as well as three director election contests it launched in 2021. Among the campaigns, he discussed how Ancora was able to get Forward Air Corp.’s (FWRD) founder and ex-CFO to help drive the activist fund’s campaign at the freight logistics company and why he thinks both strategic and PE firms could bid to buy Blucora Inc.’s (BCOR) TaxAct software business.

Finally, Chadwick also explained how he developed a passion for activism during a four-year stint working for Ralph Whitworth’s pioneering activist fund, Relational Investors LLC.

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.