Companies that institute a 5% threshold for their one-year-long anti-takeover poison pills are making an “extraordinary statement of weakness.”

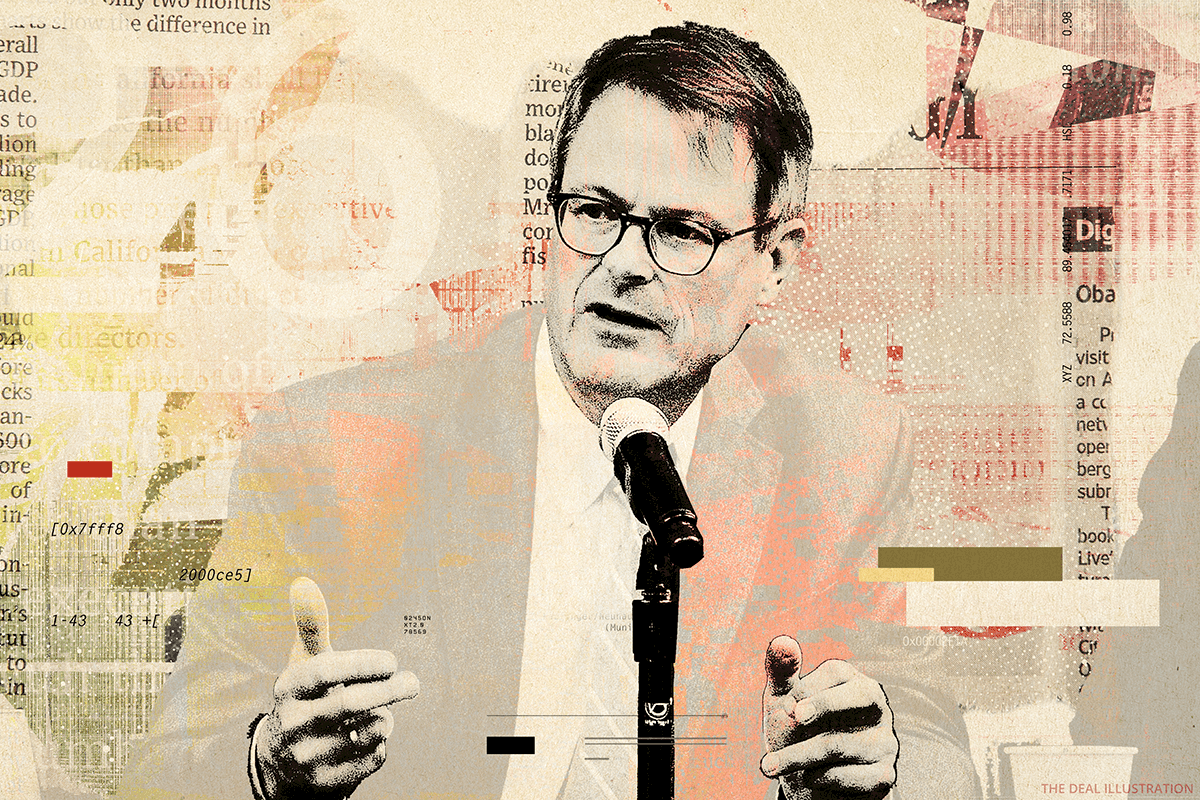

That’s according to Ken Bertsch, the outgoing executive director of the Council of Institutional Investors, an advocacy group representing U.S. asset owners with $4 trillion in assets under management. Bertsch on the Activist Investing Today podcast spoke about the advent of low-threshold poison pills, virtual meeting shenanigans and universal proxy card problems.

Bertsch co-authored “Return of the Poison Pill,” a study issued in May about the recent trend of companies installing the anti-takeover provision during the coronavirus pandemic.

Overall, companies adopted 53 poison pills, also known as shareholder rights plans, between January and June — 50 since March 10, with 20 adopted in March, 21 in April and 9 in May. Four companies, including two Maryland-incorporated REITs and energy giant Williams Cos. (WMB), adopted poison pills with the unusually low 5% threshold, even though they don’t appear to be designed to protect tax losses.

“My view is that 5% is an extraordinary statement of weakness on the part of the company,” Bertsch said. Williams “did the 5% pill and didn’t make any effort to persuade investors for why it is justified. They didn’t put it to a vote at the annual meeting. It seems extraordinary low.”

Bertsch noted companies almost never put poison pills up for a vote before adoption, even though he thought investors would support pills in many cases. He noted that Carl Icahn-targeted Occidental Petroleum Corp. (OXY) put its pill up for a vote, and it received the backing of 74% of voting shareholders.

“In the past shareholders have shown at times they are willing to vote for a pill, so it is not like, just because you put it to a vote you will never win. But companies are very reluctant to do that,” he said.

Here’s the podcast:

More podcasts from The Deal are available on iTunes, Spotify and on TheDeal.com.