With a forbearance period with noteholders set to expire, private equity-backed High Ridge Brands Co. has moved a sale process to Chapter 11.

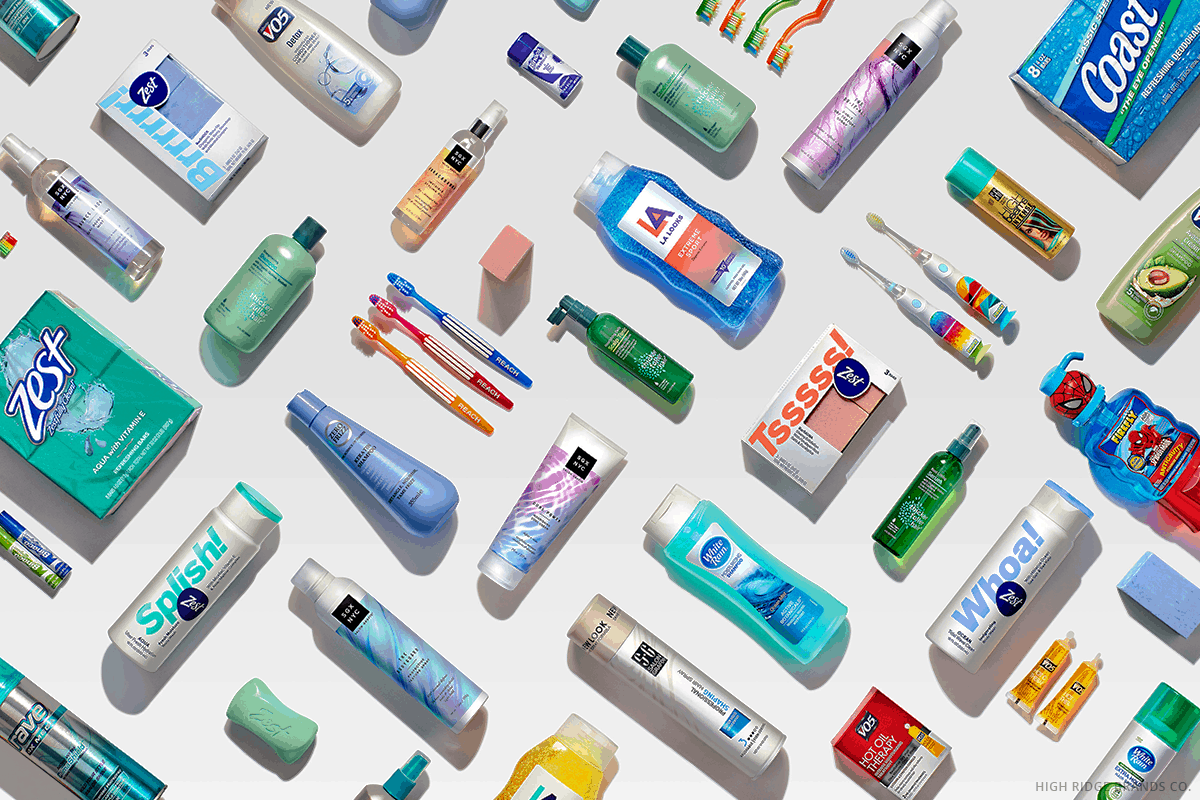

The Stamford, Conn.-based maker of personal care products such as Zest and Coast soap, White Rain and VO5 shampoo and conditioner, LA Looks hair gel, Reach toothbrushes and Binaca breath spray filed a petition on Wednesday, Dec. 18, in the U.S. Bankruptcy Court for the District of Delaware in Wilmington.

A first-day hearing has yet to be scheduled before Judge Brendan Linehan Shannon on motions including requests for joint administration of the case with those of eight affiliates and for interim use of $40 million in debtor-in-possession financing from existing first-lien lenders led by BMO Harris Bank NA. The funding includes $20 million in new money and would roll up an equal amount from $263.4 million in outstanding debt on a credit agreement.

Editor’s note: The original version of this article, including advisers and other details, was published earlier on The Deal’s premium subscription website. For access, log in to TheDeal.com or use the form below to request a free trial.

This Content is Only for The Deal Subscribers

If you’re already a subscriber, log in to view this article here.